Don’t Miss Out On Your Savings!

File STAR Application by December 31

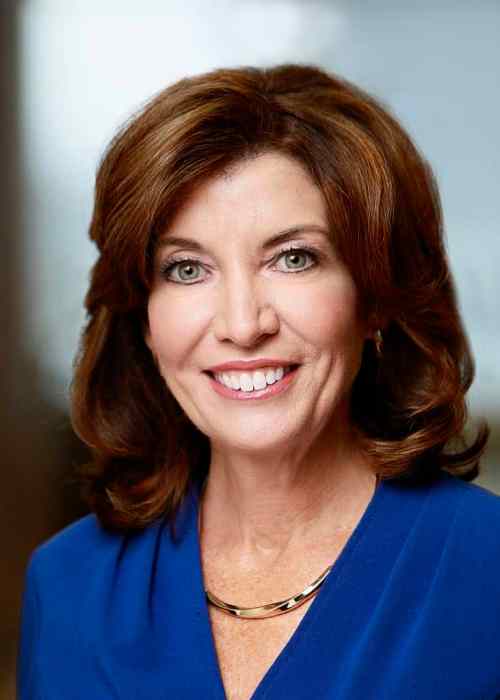

Senator Kemp Hannon is reminding everyone that it’s not too late to apply for a savings on school property taxes, but the deadline is quickly approaching.

File your STAR application by Dec. 31 to ensure that you will get your savings.

The School Tax Relief (STAR) exemption provides a partial exemption from school taxes for most owner-occupied, primary residences. The exemption consists of two parts: (1) a “Basic” exemption available to virtually all New Yorkers who own their own one, two or three family home, condominium, cooperative apartment or mobile home; and (2) an “Enhanced” exemption available to senior citizens (age 65 and older) with yearly incomes of $74,700 or less.

If you are already receiving the Basic STAR exemption or have been participating in the Enhanced STAR Income Verification Program, there is no need to re-file.

For residents who need an application or have further questions regarding the STAR program, call Senator Hannon’s community office at 739-1700 or visit www.kemphannon.com.