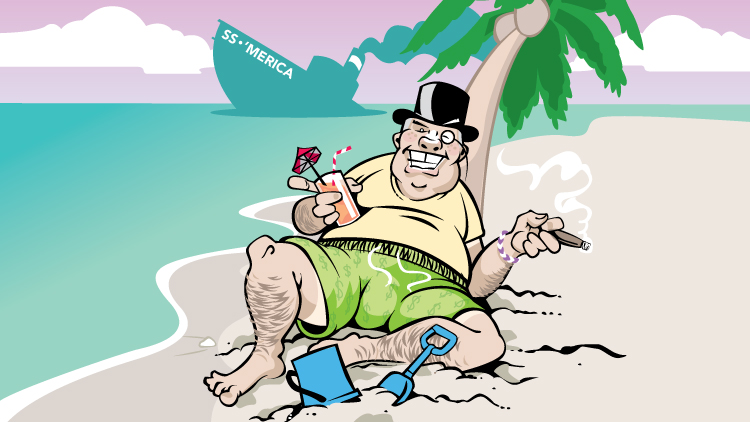

Lately I’ve been thinking a lot about the economy. Not our economy, the shadow economy run by the corporate masters of America. You can’t see it. No one can. But trust me, it’s booming.

It’s estimated that trillions of dollars from corporations, wealthy individuals and governments of small and corrupt nations are teeming through offshore accounts, robbing the home countries of domestic tax revenues. An Economist special report on offshore tax havens in February of this year cites, “James Henry, a former chief economist with McKinsey,” as saying he “believes the amount invested virtually tax-free offshore tops $21 trillion.”

Corporations, now considered people by the U.S. Supreme Court, like to refer to this money as “dry powder” just “sitting on the sidelines” waiting to be invested at any time. Indeed it is, in the most nefarious way possible.

In this magical world of paper finance the “too big to fail” banks are royalty. Since the banking collapse of 2008, they have emerged even bigger, far more profitable and just as leveraged.

Margin debt ratios, the extent to which financial institutions are leveraged in equities, are once again at pre-crash levels. After cooling off in the initial aftermath of the crisis, banks have steadily dipped their big toes back into the debt pool and begun packing on leverage at alarming rates. What’s even more insulting than the obvious recklessness this presents is that they’re not even using their own funds. The Federal Reserve has directed the U.S. Treasury to print money like mad since the crash in an effort to maintain liquidity within the system, with the banks all-too-happy to gobble it up. Given the ridiculously low interest rate environment maintained by the Fed since this time, it makes sense that the banks would take cheap government money and reinvest it.

It’s where they have invested it that warrants examination.

The easiest place for the public to spot the massive flow of liquidity is in the equity markets. The Dow Jones Industrial Average has more than doubled since it bottomed out near 6,600 immediately after the crash. And while some corporations have indeed posted substantial profits the past couple of years, overall performance and profitability are nowhere even close to explaining the gains on the Dow.

The next, most obvious place bank liquidity showed up, was in the commodities markets. The price of oil and certain agricultural products have been high for so long we have forgotten how outrageous the pricing truly is. Non-productive speculation in the commodities market has been upwards of 50 percent over the past few years, a phenomenon Dodd-Frank has yet to fix. This essentially means that nearly half of the price that you pay for a given commodity such as gasoline or milk is due to a bunch of high-frequency traders sitting at computers in Atlanta, Chicago and London.

Cheap, easy money from the Fed also means the dollar is relatively weak compared to foreign currencies. This works to the advantage of U.S. export companies, for now. But if our money is cheap, then by definition the flipside of this equation is that money is expensive in other places. The combined effect of a weak dollar and rampant speculation means that we are basically exporting inflation around the globe. The problem here is the timeless axiom: “What goes around, comes around.”

There are a couple of policy issues at play right now that should give everyone in the United States pause. The first is that the Federal Reserve has already indicated that its bond-buyback program is slowly coming to an end. As such, interest rates are gradually beginning to climb. Anyone with an adjustable-rate loan should pay even closer attention to this trend. The other consideration is that the rules of engagement in the swaps and derivatives markets haven’t changed all that much since the banking collapse. Therefore, there are still hundreds of trillions of dollars at stake in markets that no one can see.

Now add to the mix that regulators believe they will finally be able to put in place position limits on a good chunk of the activity in the derivatives market by the end of the year, and we are set for a few hairy months of fast and furious transactions as companies look to close out riskier investments. These factors alone foretell a period of volatility, particularly when the “recovery” hasn’t been so robust. Oh, and there’s a little matter of who will be the next chair of the Federal Reserve, which actually matters. A lot.

Having just vomited a bunch of financial mumbo-jumbo, now let me go back to where we began.

I’ve just given you a cursory explanation of why I believe we’re in for some serious upheaval in the financial markets between now and the end of the year. Over the next couple of months I think we will see interest rates continue to climb, a huge (albeit temporary) sell off in the commodities markets as the dollar rises and regulations tighten, and the equities market will be pounded. All of these things, were they to happen, would of course negatively impact most Americans. Higher loan costs, reduced value in pensions, and the beginning of inflation would be crippling to the American economy right now considering how tenuous the recovery is and how, according to the Associated Press, four out of five Americans are either living paycheck to paycheck, unemployed or working part-time, or below the poverty line.

Guess who will be just fine?

Because the banks are still allowed to engage in proprietary investing–meaning they can own the actual products they trade on the markets–and have trillions of “dry powder” sitting “on the sidelines,” they are more than poised to take advantage of what lies ahead. They’ll be dictating how, when and to what extent it will happen and doing so without leaving fingerprints.

Think of it like the mafia. Banks are like caporegimes and hedge funds are their hit men. Using government money the banks pack on debt and send funds to their offshore subsidiaries that, in turn, invest heavily through the hedge funds registered to places like the Caymans or Virgin Islands. Any time the big banks want to pull the plug on the equities market, they’ll do so without hesitation because they’ll have 10 times the money betting that it does.

It’s the perfect con.

Good thing we’re on to them. The corporate elite and the politicians who do their bidding will have to get up pretty early in the morning to fool the American public again. Unless, of course, there’s some big distraction like a new war in the Middle East or something. But that would be truly ridiculous.

There’s no way we’d ever fall for that old gag again.