(Photo source: Hofstra University)

On the same day Nassau County Executive Laura Curran announced that the number of confirmed COVID-19 cases in the county now exceeds 10,000, the county also released the results of a survey that shows how severely the virus has impacted most of Nassau’s businesses.

“While our dedicated first responders are on the frontlines fighting this virus, we are all bearing the brunt of the devastating financial impact on our county’s economy,” Curran said at a press conference on Thursday, April 1. “The feedback from our business community is troubling and these statistics show that there’s already a lot of pain among businesses, their employees and their families.”

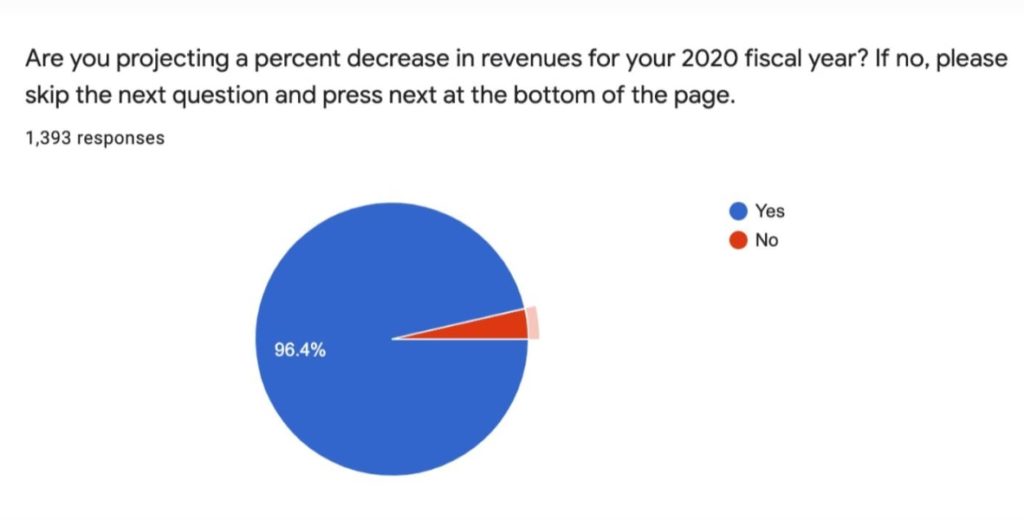

The Hofstra University-conducted survey results show the majority of the 1,431 county businesses that responded in the first week are struggling with layoffs and major declines in revenue. Forty-nine percent of the businesses that responded anticipate they will have to lay off employees as a result of coronavirus. An additional 23 percent said they may need to do so. More than half of the businesses that anticipate laying off employees, 56.2 percent, say they have done so already, while an additional 21 percent expect to have to lay people off by the end of June and the remainder at some point in 2020.

More than 96 percent of the surveyed businesses expect they will see a decrease in revenue for 2020, with 38 percent of those businesses anticipating at least a 50-percent decrease. More than 80 percent feel they will need a loan to survive the year.

To follow up on the data collected by the survey, the county has commissioned the consulting firm HR&A Advisors to study the economic impact of coronavirus in Nassau. The firm will develop projections of best-to-worse-case scenarios in Nassau so that the county will be able to use the data collected to more effectively develop countermeasures and lobby for state and federal aid.

“This data is crucial to developing projections that will help us advocate for more resources from our state and federal partners as this crisis unfolds,” Curran said. “I thank the members of our Economic Advisory Council, Hofstra University, Nassau’s IDA and Nassau’s Bar Association for stepping up to ensure we come back stronger than ever when this ends.”

While county-level unemployment data relating to coronavirus is difficult to come by given how recently the outbreak began affecting businesses, the survey numbers match up with state and federal unemployment statistics. The most recent data available from the federal Bureau of Labor Statistics (BLS) shows the unemployment rate spiked in March to a three-year high of at least 4.4 percent. Those numbers, designed to be measured on a monthly basis, may not reflect the rapid nature of economic changes. A study extrapolating from BLS statistics conducted by the New York Times estimates the current unemployment rate is probably around 13 percent.

While March unemployment data for New York State is not yet available, the U.S. Department of Labor reported a sharp increase in unemployment insurance claims at the end of March. For the week ending on March 14, 14,272 New Yorkers filed for unemployment insurance. The following week, 79,999 did so.

National unemployment claim statistics are even more staggering. While around 200,000 people have filed initial claims for unemployment insurance every week in the last half decade, nearly 10,000,000 did so in just the last two weeks of March. The week of March 22 saw 3.3 million claims, shattering every record since the labor department first began tracking the statistic. The following week saw twice as many claims.

Small businesses struggling to make ends meet during the pandemic may apply for assistance through a number of grant and loan programs. The U.S. Small Business Administration (SBA) is providing economic injury disaster loans for small businesses. In order to apply for one of the loans, a business must be able to prove substantial economic injury has occured that renders it unable to support its typical operating expenses. Visit www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources for more information.

In addition to standard SBA programs, the federal CARES Act signed into law on March 28 includes $376 billion in relief funds aimed at workers and small businesses, including resources like a paycheck protection program and loan advances of up to $10,000. Visit www.sba.gov/funding-programs/loans/coronavirus-relief-options for more information.