By Svea Herbst-Bayliss

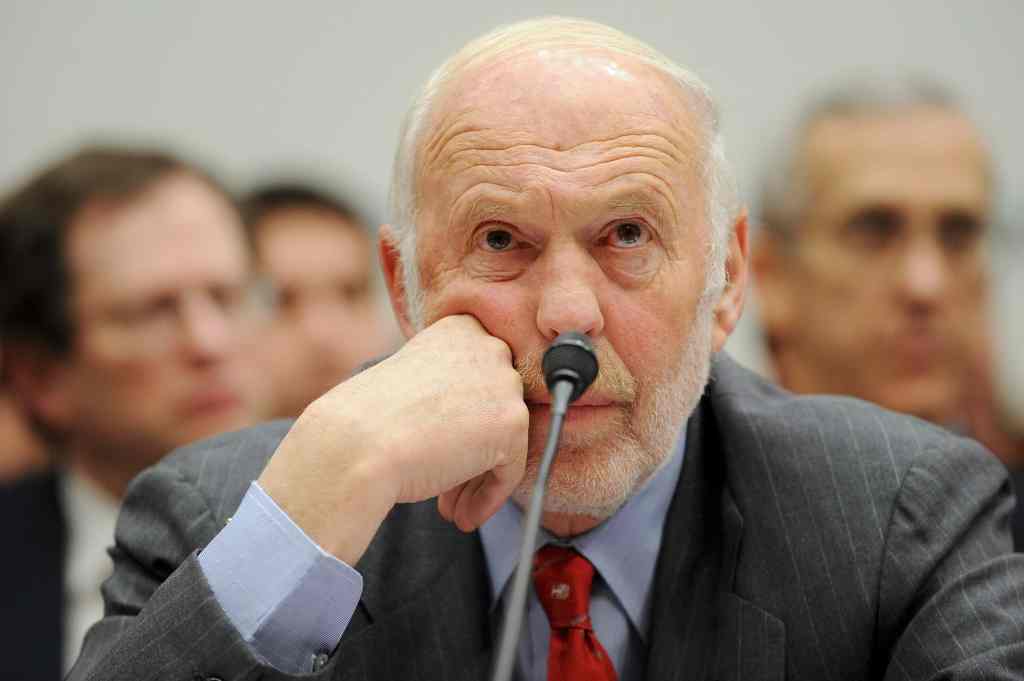

Billionaire investor James Simons, of Long Island, is stepping down as chairman at the Setauket-based Renaissance Technologies but will remain on the board of the $60 billion hedge fund he founded nearly 40 years ago.

Simons told investors late in 2020 — a year of mixed returns for the firm — that he would be handing the reins as board chairman to Peter Brown, who has been running the company as sole CEO since 2017. The move signaled a shift after Simons named his son, Nathaniel, as co-chair of the board in January 2020. James and Nathaniel Simons will remain as board directors.

“Simply put, I believe it is time: this transition has been many years in the making and Peter Brown, our incoming Chairman, is more than ready to take on the responsibility,” Simons wrote in the letter, seen by Reuters.

The Wall Street Journal first reported the move.

Simons, who will turn 83 this year, is a former mathematics professor and code breaker who turned Renaissance into one of the world’s most successful hedge funds since its 1982 launch.

Simons retired and stepped down as CEO in 2010, handing over to Brown and Robert Mercer, who were co-CEOs until 2017.

Mercer stepped down amid controversy over his strong support of Donald Trump and the media outlet Breitbart News. Simons, whose net worth was estimated at $23.5 billion in 2020 by Forbes, donated millions to elect Joe Biden as president.

Investors have been drawn to quant funds like Renaissance where computers instead of star stock-pickers make the allocations, for years.

But in 2020, returns at Renaissance were mixed.

Its Medallion Fund, available only to Renaissance insiders, returned 76%. But its Renaissance Institutional Equities Fund, the oldest portfolio available to outsiders which was launched in 2005, tumbled nearly 20%, a person familiar with the numbers said.

Simons acknowledged the returns in his letter, writing “I know it has been a difficult year and that Renaissance has been through challenging periods before, but I continue to believe in our processes and our people. I remain fully committed to our investors, to our employees, and to our firm, and I am stepping down as Chair because I believe that is what’s best for the firm.”

(Reporting by Svea Herbst-Bayliss; Editing by David Gregorio)