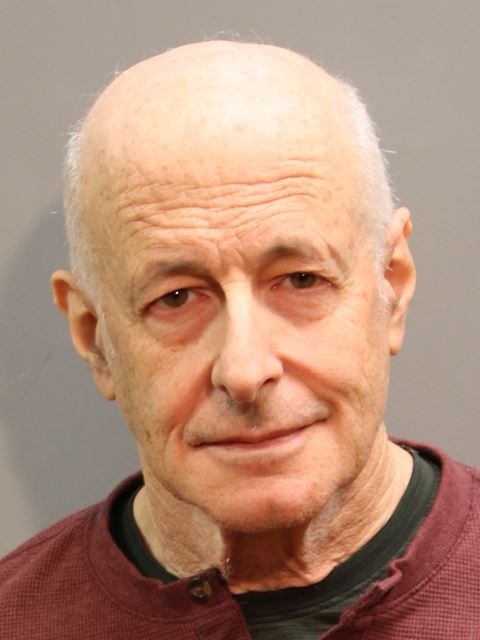

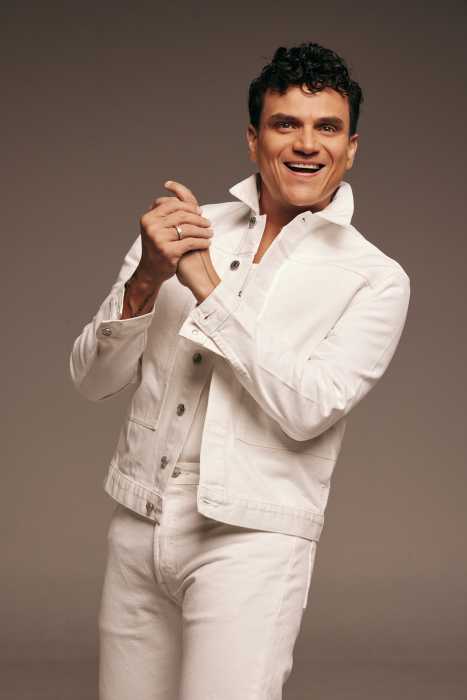

An attorney from Merrick admitted to using the online university he founded to con investors in an $86-million stock pump-and-dump scheme with the help of his company’s former CEO four years ago.

Darren Ofsink, 48, pleaded guilty Wednesday at Brooklyn federal court to conspiracy to commit securities fraud along with 56-year-old Ira Shapiro of Congers.

Prosecutors said the duo led CodeSmart Holdings, a publicly-traded company, when they engineered a reverse merger with a public shell company, gained control of CodeSmart’s three million unrestricted shares and twice fraudulently inflated the company’s share price and trading volume before selling their shares at a profit between May and September 2013.

The first time, they pumped stock prices from $1.77 to $6.94 before dumping it and months later, they pumped it from $2.19 to $4.60 before selling, authorities said. But company paperwork they filed with the U.S. Securities and Exchange Commission listed only $6,000 in total assets, $7,600 in revenue and a net loss of $103,141. By July of the following year, the company’s stock was valued at one cent per share.

They face up to five years in prison, a fine, forfeiture of proceeds and will be required to make full restitution to their victims when sentenced by U.S. District Judge Eric Vitaliano.