The Herricks School District Board of Education has temporarily tabled its participation in a recent bill signed by New York State Governor Andrew Cuomo that would provide school tax exemptions for veterans of the United States military living in the district.

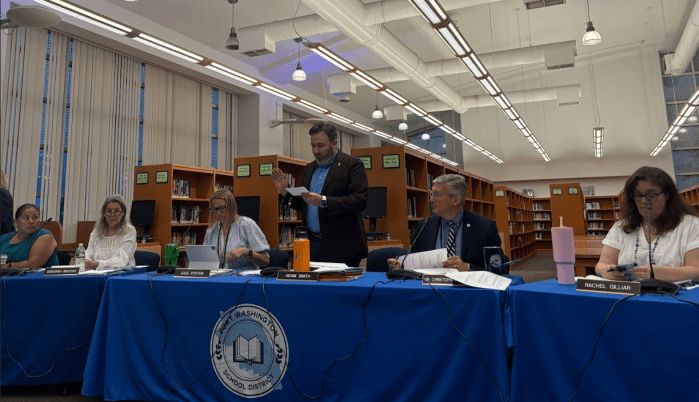

Board President James Gounaris, at a meeting on March 6, said that while the door would remain open for future participation in the program, several potential issues with the bill that made him and his trustees reluctant to opt in at this time

“There is the issue that we continue to have with the Nassau County Assessor’s Office, and their inability to give us good data on who is legitimate and who is qualified for the program and who is not,” he said. “The board is in favor of offering the exemption, but the problem is, how do we qualify the exemption for all these people without affecting others who may or may not qualify? Veterans who may be mistakenly excluded may pay a higher rate when they may have been qualified to participate.”

Another issue Gounaris mentioned was the inability of a school district to cease their involvement with the program if it turned out to harm the district.

“If we opt in, and there’s an issue, we can’t opt out,” he said. “Hopefully, at a later date, the state will choose to remove that addendum and allow schools to opt out.”

The veteran school tax exemptions, in their current form, are broken down into three tiers, each offering different levels of benefits: non-combat veteran, a combat veteran, and disabled veteran. In addition, exemptions would be available for residents whose children were killed while in military service (known as Gold Star Parents) as well.

If the tax exemption is to be applied to the 2014-15 school year, it must be adopted by March 15. However, Gounaris noted that there’s the future possibility of opting in for the current fiscal year if the state extends the deadline for adoption.

“We believe that offering the exemption is the honorable and right thing to do,” he said. “Unfortunately, the people who are providing us the data can’t qualify for us who is supposed to get the exemption, and at what rate. However, we don’t want to outright vote no, so instead we are going to table it.”

Certs Savings

Superintendent of Schools Dr. John Bierwirth had noted Herricks had previously put $350,000 in reserve in case school districts had lost a tax certiorari lawsuit against the county and would be forced to pay out property tax assessment refunds to Nassau County residents. The board came up with a constructive way to spend those funds to the betterment of the district’s schools.

Dividing the $350,000 amongst the current 2013-14 and upcoming 2014-15 budgets, the newly-freed up tax certiorari funds will be used to provide new blacktop at the Denton Avenue and Center Street schools, a new playground at Searingtown School and various technology-related expenses, leaving a remaining balance of $61,000 to be carried over to the district’s upcoming budget.