Taking the confusion out of the process

Medicare’s annual open enrollment period begins soon. During this time, Medicare beneficiaries make important choices that affect their medical costs, the doctors they see and prescription coverage. There is a lot of information about open enrollment out there, yet for many older adults the process can be challenging.

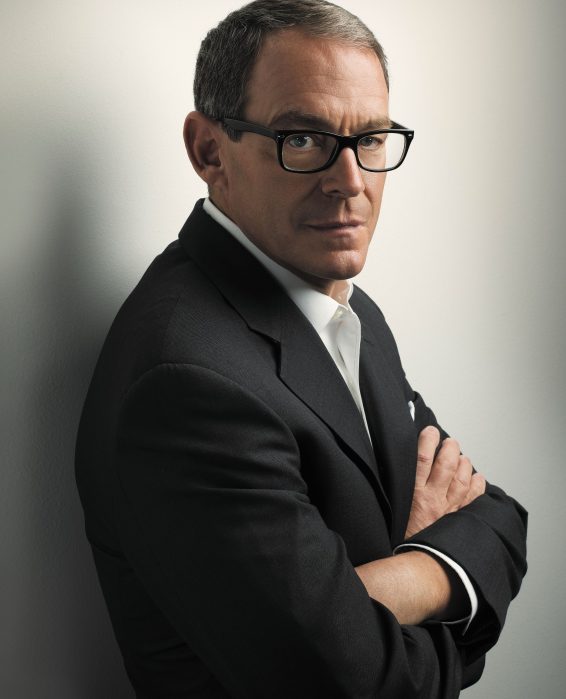

Dr. Anthony Ardito, the chair department of medicine and chief medical officer for ProHEALTH Medical Management in Long Island, provides useful tips and information to help older adults and their caregivers navigate open enrollment.

Q: How do I get Medicare coverage?

Dr. Anthony Ardito: There are several ways to get Medicare coverage. You can choose Original Medicare (Parts A and B). Part A is hospital coverage and Part B is medical coverage. Coverage is provided by the federal government. You can also get benefits through a Medicare Advantage plan (called Part C). Medicare Advantage plans combine Part A and Part B coverage. Many plans also include prescription drug coverage (Part D) and offer additional benefits not provided by Original Medicare. Plans are offered by private insurance companies approved by Medicare. There is also what’s known as Medicare supplement plans. These plans help cover some of what Medicare Parts A and B don’t pay, such as portions of coinsurance, copayments and deductibles.

Q: What are some of the things I should think about when choosing coverage?

A: Ask yourself these questions: How often do you visit the doctor? What prescription medications do you regularly take? Do you have a particular doctor, hospital or pharmacy that you want to use? Do you have retirement health coverage? Would you rather pay less in monthly premiums or pay less out of pocket when you receive health care?

Q: What is the best way to get information to make smart decisions during open enrollment?

A: A great place to start is with your doctors. If you like your doctors, confirm that they will be in the care provider network for the health plan you choose. Don’t assume that your doctors will stay in the same network each year. Visit www.medicare.gov; call or contact Medicare Advantage health plans directly. You can also find information at www.MedicareMadeClear.com. Another good resource is an independent licensed insurance agent or health plan sales agent as they help Medicare beneficiaries learn about their benefit options, what’s going to fit their needs and how they can continue to see the doctors they prefer.

Q: Why is the topic of health care planning so stressful?

A: Health care is a concern for everyone, and people want to make the right decisions that work best for their needs. It can be stressful for caretakers—people who make these decisions for their friends or family members—because they don’t want to make a decision that will hurt the Medicare beneficiary financially or otherwise. The more you know and the sooner you know it, you can do your research and then make a decision. Give yourself time to make the decisions that will be right for you.

Anthony Ardito, M.D., is the Chair Department of Medicine, Chief Medical Officer at ProHEALTH Medical Management in Long Island, NY.