Executives of East Setauket-based hedge fund Renaissance Technologies LLC could pay as much as $7 billion to U.S. tax authorities after agreeing to settle a dispute over whether they improperly reduced their tax liability from trading profits, according to a letter reviewed by Reuters and a source familiar with the matter.

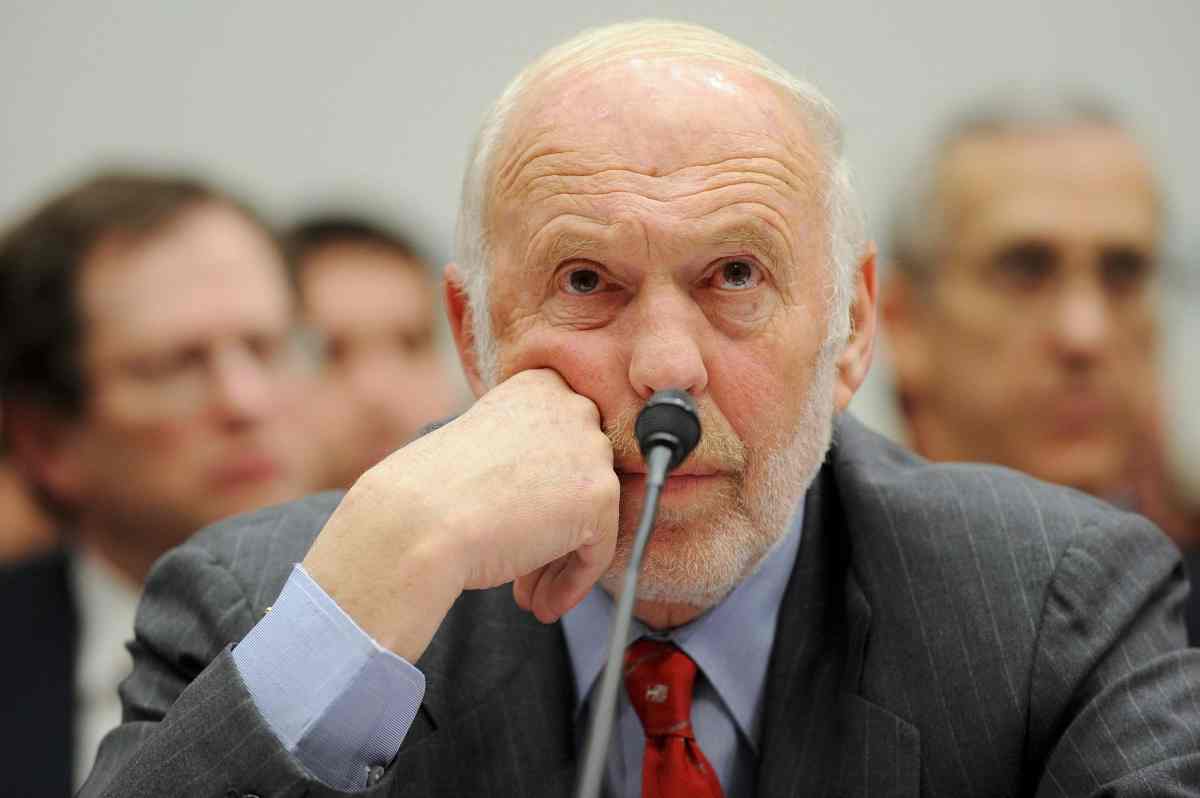

James Simons, the founder of one of the world’s most successful quantitative hedge funds and a major Democrat donor, will make an additional settlement payment of $670 million to the Internal Revenue Service, according to the letter from Renaissance‘s Chief Executive Peter Brown sent on Thursday to investors.

In describing the settlement, one of the largest in IRS history, Brown wrote that the fund worked through the IRS appeals process for several years before concluding that it was better to agree to the resolution “rather than risking a worse outcome, including harsher terms and penalties, that could result from litigation.”

The settlement comes after former U.S. Senator Carl Levin in 2014 detailed a practice in which Deutsche Bank AG and Barclays Plc helped several hedge funds, including Renaissance, treat some capital gains as longer-term profits, attracting a lower tax rate, than gains made from trades on assets held for less than a year. The banks sold the funds options to help them achieve that outcome, the report said.

In the letter, Brown said the trades in question were done by its flagship Medallion fund between 2005 and 2015. Medallion is solely managed internally for friends and family.

The IRS did not immediately respond to Reuters’ request for comment. Barclays and Deutsche Bank declined to comment. The Wall Street Journal earlier reported news of the settlement.

Levin died in July, aged 87.

“I wish Senator Levin were here, seven years after he first exposed its outrageous tax scam, to see RenTec finally held accountable,” said Elise Bean, a former longtime aide.

“It’s good to see that, despite a years-long knock-down bare-knuckles battle, the IRS prevailed in compelling at least one set of billionaires to pay the taxes they owe,” Bean said.

Levin in 2014 had presented the findings of a year-long probe into basket options, calling for tougher action from the authorities. The report said the largest user of the options, Renaissance Technologies Corp, saved an estimated $6.8 billion in taxes.

In 2015, the IRS issued guidance that hedge funds using “basket options” had to report them on their tax returns and correct past returns, which came after a U.S. Senate subcommittee reported some funds were using this to avoid federal taxes.

According to Renaissance‘s investor letter, the seven individuals who were members of Renaissance‘s board during those years, and their spouses, will be required to pay the tax and interest and penalties. Investors in the fund will be required to pay additional tax and interest but not penalties.

The payment would dwarf that of a transfer pricing dispute with GlaxoSmithKline in 2006 which saw the drug firm pay $3.4 billion. The IRS’s press statement said at the time it was the largest single payment to the IRS to resolve a tax dispute.