Estate administration is part of the ordinary course of handling the affairs of a deceased loved one. But beware: there are traps for the unwary. Some problems can be avoided by proper planning, others by good practices during the estate administration process.

1. Internet Forms

Estate Planning on the internet is a major mistake. Wills have important technical requirements in order to be valid. All Wills must be admitted to Probate and the Courts scrutinize Wills carefully in order to ensure that the testator’s wishes are followed. Internet or self-prepared Wills are easy for disgruntled heirs to challenge.

2. Medicaid Liens

Medicaid must be paid back before any beneficiaries can receive an inheritance from the estate. Medicaid will also attach a lien to any real estate owned by the Medicaid recipient during their lifetime and collect upon it at the time of death. The better way to address this is through asset protection planning, including transferring the home and other assets to an irrevocable trust.

3. Transparency

Heirs and beneficiaries left in the dark often assume something nefarious is going on with the assets and the estate. Not being transparent with beneficiaries often leads to litigation, whether that is a Will contest, a trust contest, a contested accounting, or an action to remove a fiduciary. If you are an executor or administrator, keep the beneficiaries informed of the status and actions you are taking on behalf of the estate or trust.

4. Taxes

Don’t forget about taxes! The Executor must file a final income tax return on behalf of the decedent for the year of death and make sure all prior tax returns have been filed and all taxes paid. If there is income earned after death, the estate needs to file an estate tax return and possibly pay taxes. There is also an estate tax on the value of the estate at the time of death.

5. Scrambling to Find Information

If the deceased did not have their affairs organized, it can take a Herculean effort to get a handle on assets, income, important documents, funeral and burial arrangements, life insurance information, online logins and passwords, and other information needed to handle the decedent’s final affairs. Cona Elder Law offers a Legacy Logbook: A one-stop

resource for clients to assist family in locating that information after a loved one’s passing. Contact us today to secure yours.

Probate and estate administration are long enough procedures as it is. Don’t extend it by making these mistakes.

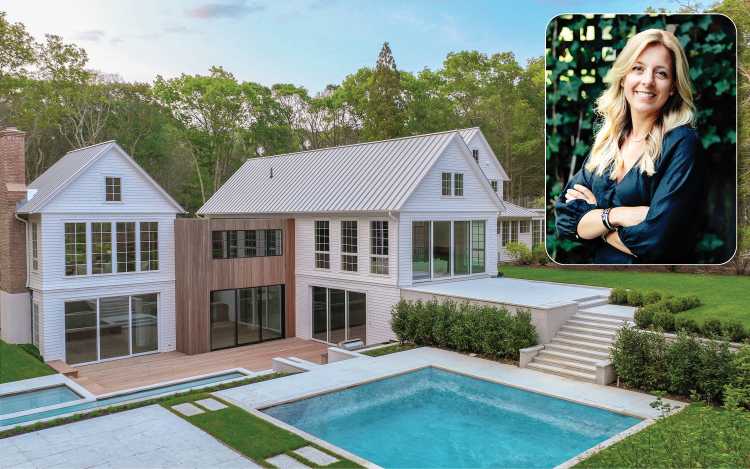

Jennifer B. Cona, Esq. is the Founder and Managing Partner of Cona Elder Law PLLC. Cona Elder Law is an award-winning law firm concentrating in the areas of elder law, estate planning, estate administration and litigation, and health care law. The firm has been ranked the #1 Elder Law Firm by Long Island Business News for eight consecutive years. For additional information, visit conaelderlaw.com.

Jennifer B. Cona, Esq. is the Founder and Managing Partner of Cona Elder Law PLLC. Cona Elder Law is an award-winning law firm concentrating in the areas of elder law, estate planning, estate administration and litigation, and health care law. The firm has been ranked the #1 Elder Law Firm by Long Island Business News for eight consecutive years. For additional information, visit conaelderlaw.com.

Sign up for Long Island Press’ email newsletters here. Sign up for home delivery of Long Island Press here. Sign up for discounts by becoming a Long Island Press community partner here.