Small businesses are a vital part of the U.S. economy but even more so in NY. According to a report released by State Comptroller Thomas DiNapoli, small businesses support nearly 3.9 million jobs and generate more than $950 billion in annual revenues. The sector is a major segment of NYS’s economy.

Small businesses are a vital part of the U.S. economy but even more so in NY. According to a report released by State Comptroller Thomas DiNapoli, small businesses support nearly 3.9 million jobs and generate more than $950 billion in annual revenues. The sector is a major segment of NYS’s economy.

“Small businesses help drive NY’s economy,” DiNapoli said. “From neighborhood coffee shops to start-up tech firms, small businesses account for more than half of all private-sector employment and provide almost $190 billion in annual payrolls. These businesses are critical to NY’s economy and integral to the fabric of life in the Empire State.”

The U.S. Small Business Administration (SBA) defines a small business as one with fewer than 500 employees. Such businesses account for more than 99 percent of all businesses, both nationally and in NY.

This segment generated $954 billion in receipts in 2012 accounting for approximately 43 percent of all business receipts in NY.

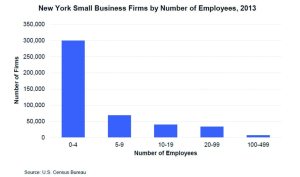

Of the 455,000 businesses in NY, more than 451,000 are small businesses with two-thirds of small businesses having fewer than five employees. Firms with 20 to 99 employees comprised approximately one-third of the total small business employment with over 1.2 million employees. The larger firms (those with 100 to 499 employees) had the highest average payroll per employee, nearly $56,000 per year.

Over the past decade, NY’s small businesses generally fared better than the nation’s as a whole. Small business employment in the state rose by a net 1.6 percent in the 10-year period through 2013, while declining nationally by 1.1 percent. During this same 10-year period, the number of small businesses remained unchanged nationally but rose 5 percent in NY.

Wholesale and retail trade, professional services, leisure activities and health services are the dominant sectors of the small business economy.

There are a number of programs available to businesses from NY state. The In-State Private Equity Program, the NYS Common Retirement Fund has committed $1.3 billion to private equity investment in NY as of Dec. 31, 2015. Some $844 million has been invested in 322 companies, putting public pension fund dollars to work in startup, emerging and established businesses.

Recently, a NY Credit Small Business Investment Company Fund was created by NYS to provide credit financing to eligible companies and deliver attractive returns to the state pension fund. The fund provides capital to businesses that are implementing growth strategies, expanding operations or transitioning ownership. The fund’s lending partnership with the NY Business Development Corporation provides capital for small business loans throughout the state. For more information go to www.osc.state.ny.us/reports/economic/economic_impact_small_business_2016.pdf.