The Village of Mineola saved more than half the cost of tax appeals filed against it in the last year, reducing the total of $519,764 by negotiating settlements to $250,000.

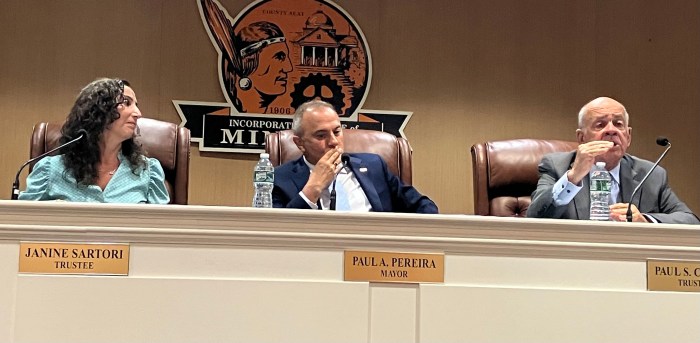

At last Wednesday night’s board of trustees meeting, village officials said the reassessment of all village property values in 2006 has enabled a significant reduction in the tax certioraris in the intervening years.

Mineola Deputy Mayor Paul Pereira said tax grievances, formally called tax certioraris, cost the village $1 million in 2008.

“Imagine what we’ve been able to do with that money,” said Pereira. “We can do more without raising village taxes. That’s all to do with sticking with a plan and following through.”

Village officials estimated the total amount of tax grievances filed in 2008 was initially between $3 million and $4 million, ultimately reduced to $1 million through negotiation. Village officials said $330,000 had been budgeted in the 2016-17 fiscal year to cover the anticipated cost of resolving outstanding tax appeals. Village attorney John Gibbons said his law firm had projected the reduction the village would pay on the current tax grievances at $280,000, but succeeded in knocking the figure down to a total payout of $250,000. The tax certioraris represented 24 commercial tax appeals.

Village officials said an annual readjustment of property values maintained the trend of reducing the total number and cost of tax grievances filed each year.

“We whittled away at it over the years,” Mayor Scott Strauss said after the meeting. “We assess properties every year. We base it on fair market values.”

Strauss said village assessors adjust the values annually based on home sales, aided by input from an outside real estate consultant to render real market values on all properties. A more complex calculation is applied to revalue commercial property, village officials said.

Village officials said regularly revaluing all properties in real market terms reduces the incidence of tax appeals.

Strauss called tax certioraris “a necessary evil,” but added that he encourages homeowners to file tax grievances if they question their assessments. He said the average Mineola homeowner currently pays $1,500 annually in village taxes.

Trustee Dennis Walsh recalled that the village paid a total of $1.3 million to resolve tax grievances in 2003, with reductions from that peak ensuing after the village-wide reassessment three years later.

“That all started with the reassessment, but we have to continue to reassess,” Walsh said.

Walsh noted that village taxes are currently divided evenly between residential and commercial properties.