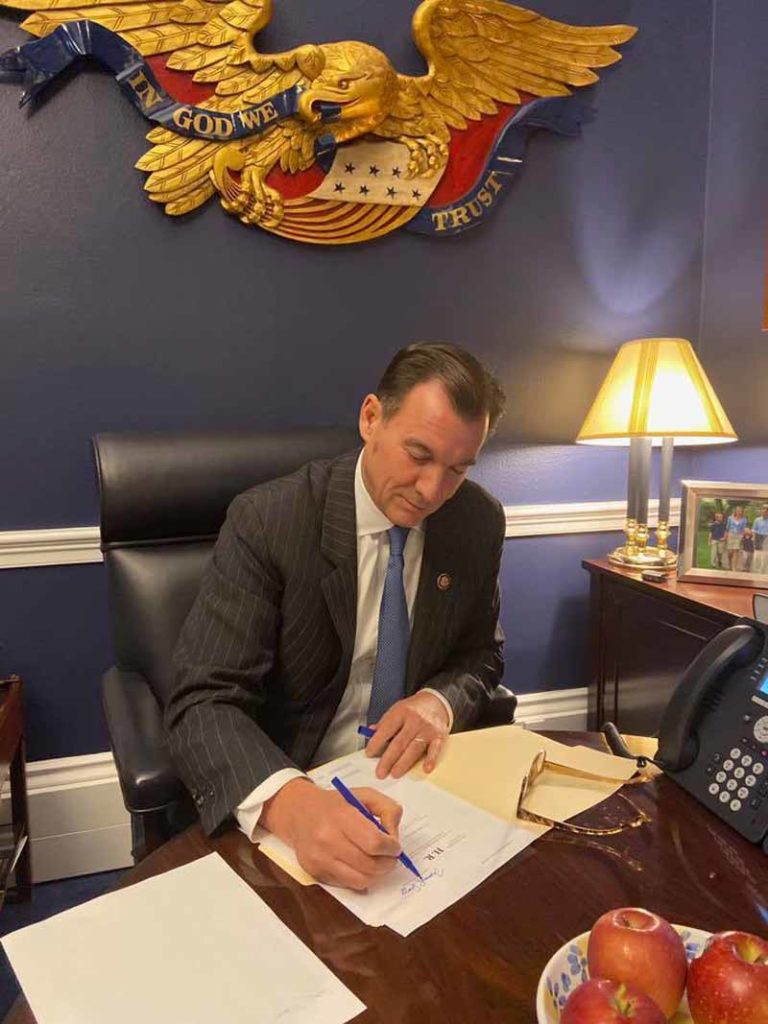

A bill sponsored by U.S. Congressman Tom Suozzi to temporarily repeal a cap state and local tax (SALT) deductions passed in the House of Representatives on Thursday, Dec. 19 by a vote of 218-206.

The bill would allow married couples filing taxes jointly to deduct up to $20,000 in state and local taxes from their federal tax bill in the 2019 tax year, and fully reinstate the SALT deduction for 2020 and 2021. To make up for the lost tax revenue phasing out the cap would generate, the bill proposes raising the tax rate for the top tax bracket ($510,301 for individuals or $612,351 for married couples filing together) from 37 percent to 39.6 percent.

The bill is an attempt to nullify the $10,000 SALT cap for both individual and joint filings instituted by the GOP’s federal tax bill in 2017, which was put in place to offset revenue loss from tax cuts to corporations and middle class families across the country. The cap has drawn heavy criticism from politicians in high-tax states like New York and California, where property taxes often exceed the $10,000 cap, for placing a greater burden on their residents and local governments.

“Amid all the turmoil in DC, I am thrilled that the House, with bipartisan support, has passed my legislation to restore tax fairness for my constituents on Long Island,” Suozzi, who represents Bethpage, said in a statement. “The 2017 cap on SALT broke a century-old agreement, a covenant to protect state and local government. My bill restores that covenant, and it restores fairness as well.”

According to the Government Finance Officers Association, just under 52 percent of the households in Suozzi’s New York 3rd Congressional District claimed SALT deductions in 2016.

Republican Congressman Lee Zeldin voted “no” to the bill, and has argued that the SALT deduction should be reinstated in full, instead of just until 2021. Back in April, Zeldin introduced a competing bill that would retroactively reinstate the SALT deduction and make up for the difference in tax revenue by “closing previously unaddressed loopholes” instead of raising the top tax rate, which Zeldin has argued would harm families and small businesses. The legislation has stalled in committee.

December’s vote fell largely along party lines. Only five Republicans issues “yes” votes, including Peter King, who represents New York’s 2nd Congressional District, which includes Farmingdale. King argued the cap placed further strain on Long Island taxpayers, who already pay more in federal taxes than they receive in benefits.

“Eliminating deductions for local and state taxes will have a devastating effect on New York,” New York Second District Congressman Peter King said in a statement. “We give far more to Washington than we get back. For every dollar we give, we get $.79 back. That’s a $48 billion shortfall and hurts our middle-class Long Islanders. This legislation is critical.”

The resolution will now make its way through the Senate, where it is expected to be voted down. If it were to pass in the chamber, President Donald Trump has said he would veto the bill.