The Glen Cove City Council approved to preempt its sales tax starting in March, passing the resolution with four votes in favor, two oppositions and one abstention at its Tuesday, July 22 meeting.

Mayor Pam Panzenbeck and Council Members Kevin Maccarone, Grady Farnan and Michael Ktistakis voted in favor of the resolution. Council Members Marsha Silverman and John Zozzaro voted against the resolution, and Council Member Danielle Fugazy Scagliola abstained from the vote.

The vote was preceded by a discussion with council members and residents that weighed both perceived benefits and drawbacks.

The new enactment will allow the city to retrieve half of its sales tax, which is shared with Nassau County, but will remove the current county property tax rebate given to homeowners.

City Attorney Tip Henderson said the city and the county share a 3% sales tax imposed on items sold within Glen Cove. He said that under the new enactment, both the city and the county would get 1.5% of the sales tax.

Henderson said the county currently collects all sales taxes and allocates a certain amount within its budget. He said the leftover funds are shared with towns, villages and cities within Nassau and is used as a credit on county property taxes.

Comptroller Michael Piccirillo said the amount credited to the city fluctuates and has ranged between approximately $1.3 million and $2.6 million over the past five years, averaging approximately $2.2 million.

Henderson said that if a city were to preempt its sales tax, it would not receive credit towards residents’ county property taxes. Instead, he said the preempted funds would go directly into the general fund and could be utilized to reduce city taxes and fund city services.

Piccirillo said he believes that the amount generated with a 1.5% preemption on the sales tax will generate more than that average.

He said the City of Long Beach has implemented its own preemption for approximately 30 to 40 years, and said it generates approximately $3.5 million to $4 million through its sales tax.

Maccarone said the new sales tax model will not add an additional tax within the city, which had been some residents’ concern.

Piccirillo said he “wholeheartedly recommends” the resolution because it is a “recurrent revenue stream.” He said the additional revenue will help “stabilize the tax rate.”

“There’s an opportunity here to get a multi-million dollar revenue stream that we can use to offset all of our normal city services, all the expense increases,” he said.

Panzenbeck said she has the “greatest faith” in Piccirillo and noted that he and Henderson had been investigating the matter for almost a year before bringing it to the council’s attention.

Council members asked for data from the state and county about how much would be generated with the new preemption, but Henderson and Piccirillo said that data does not exist as the city’s sales tax had not been calculated on its own in the former sales tax model.

Silverman, who works in data analytics, said there are “always ways to get data” and asked if the state could run a program to examine the next 12 months.

Henderson said there is no way for the state to predict it.

Piccirollo said the city cannot determine how much it would have garnered from a preemption in previous years because data has not been collected for “vendors charging sales tax in Glen Cove.”

“The only way you’re going to get what you are asking for is to step into the water and test it,” Henderson said.

Council members shared their concerns that residents’ county property taxes will increase under the preemption.

Fugazy Scagliola said she would like to see the money generated through the sales tax to reduce Glen Cove’s property taxes, as Nassau’s property taxes will increase without the rebate.

“It would be nice, if we knew we were going to do something like this, that we knew we were going to give some money back to the property owners, because they’re the ones right now that are being squeezed by this,” she said.

Piccirillo said it is “premature” to examine next year’s budget, but the intent is to use it to reduce city taxes and mitigate other cost increases.

Maccarone said the county’s rebate fluctuates year-to-year. He said the county’s tax credit and the city’s preemption would be “commensurate, either way, to the economy.”

Silverman said the enactment will “hurt taxpayers.” She said she spoke with people at the county who confirmed that there would be county property tax increases, but would not name who she spoke to when asked.

“You’re putting the tax burden on property owners,” she said.

Henderson said Silverman is “characterizing it incorrectly.”

Five residents spoke at the meeting to share their questions about the matter.

David Nieri said that approximately 40 years ago, the city enacted a similar motion and generated less money than the county would have shared. He said the administration rescinded the enactment after about four years, and had kept it enacted for too long because the council did not want to admit they were wrong.

“I promise, if this doesn’t work out, we will rescind. I am never too proud to admit mistakes,” Panzenbeck said.

John Perrone, who previously announced his run for council member in November, said the motion feels like a “bait and switch on taxes” and that the council does not know its “full implication”.

“It doesn’t sound like it’s been researched enough,” he said.

Rick Smith said that the business owners who “write the checks to the state” are unaware of the plan and said there should be more opportunity to discuss it.

Silverman and Fugazy Scagliola asked why the vote has to take place in July, noting that they had not learned about the matter in the months that Henderson and Piccirillo were working on it. Henderson said there are “timeframes that we have to fulfill” and must notify the state and county.

Silverman and Fugazy Scagliola both introduced motions to table to vote for the August meeting and said they wanted to learn more about the matter in the meantime. Both motions were denied. The first motion was denied so the public could comment on the matter, and the second motion was denied before the council voted.

Fugazy Scagliola said she thinks the city should control its money instead of the county, but she wanted to further inform and discuss this with residents prior to its implementation.

Silverman said a flier in the mail campaigning for Panzenbeck states she is “holding the line on taxes in 2026.” She said the 2026 budget has not been created or voted on, and questioned whether the sales tax revenue will be used to “plug holes” in the budget.

Panzenbeck did not respond.

Maccarone noted that in the past four years under Panzenbeck, taxes were raised approximately 2%, and under former Mayor Timothy Tenke, whom he said Silverman was “leading the charge with,” taxes were raised approximately 12% in four years.

Silverman said those were “alternative facts.”

According to the resolution, the preemptive sales tax will begin on March 1.

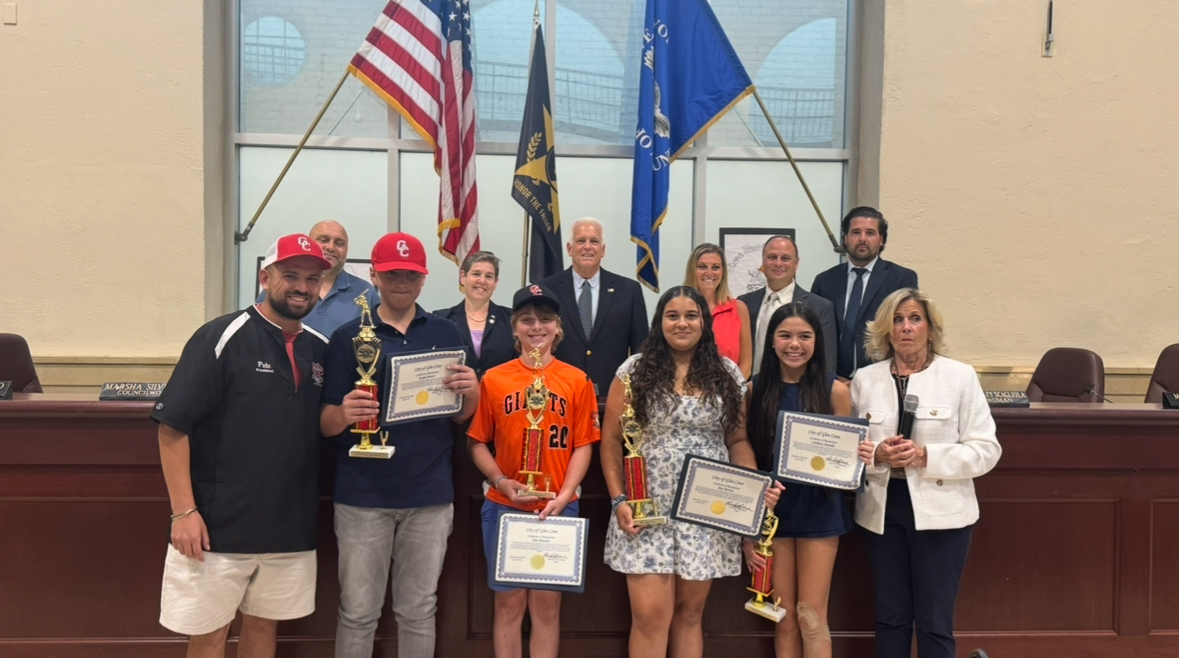

Despite the council members’ disagreement, the council meeting began with celebrations, with four citations awarded to Glen Cove Little Leaguers and Frank Pena inducted into the hall of fame.

Youngsters Mia Berrios, Kathleen Anello, Tate Bennet and Joseph Portaro were all celebrated for their commitment to the Little League, having completed all levels of softball and baseball from t-ball to majors, Panzenbeck said.

“We just love to honor our Glen Cove kids because they never cease to impress and amaze us with their talents,” she said.

Panzenbeck said their dedication to the Little League showcases their athletic skills, sportsmanship and perseverance.

Pena was inducted into the Hall of Fame for boxing as a coach and administrator after dedicating decades of his life to the sport. The Hall of Fame Committee said his impact has extended “beyond the ring” by fostering a tight-knit community and mentoring many in the city.

“Frank has shaped the lives of countless young athletes with integrity and passion,” Panzenbeck said.

Maccarone said the Hall of Fame at the city’s stadium inducts individuals based on “their excellence and their commitment to sports as well as our community.”