More employers are giving workers the option to tame health insurance costs for next year if they provide a blood sample and reveal details about their health habits.

As they present employees with benefits options for 2012, some companies also are offering lower rates to those who quit smoking, lose weight or take other measures to improve their health.

Companies are trying to curb health insurance costs that have soared 50 percent or more over the last five years, benefits experts say, far outpacing worker wage and corporate earnings increases.

However, the push can create friction. More than 600 Indiana University employees signed a petition last fall protesting the school’s offer of cost breaks, with many raising privacy concerns about a health questionnaire required by the program.

Insurance costs are expected to grow at a slower rate next year, in part because growth in the use of health care is slowing as people try to limit expenses in a tough economy. But companies are still being squeezed, and many have already switched to cheaper plans or asked workers to pay a bigger share of insurance costs, so they’re looking for another way to trim expenses.

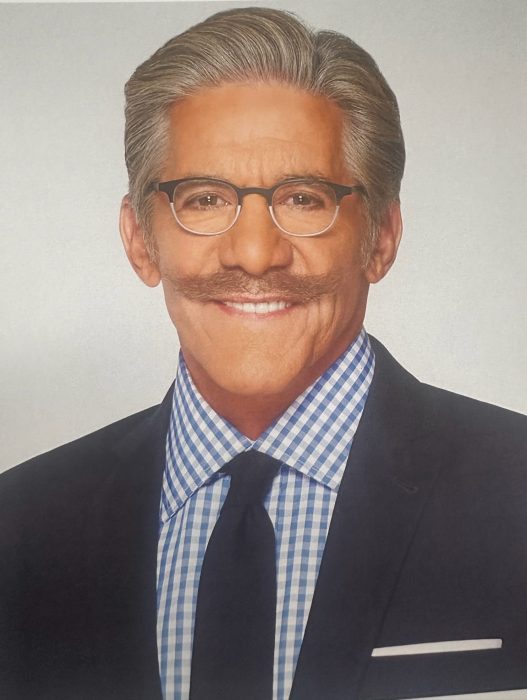

“Employers are overwhelmingly recognizing that if they are ever going to get their arms around health care costs, they have to start by getting their employee population healthier,” said Jim Winkler of the benefits consulting firm Aon Hewitt.

Employer-sponsored health insurance covers more about 150 million people in the United States, or nearly half the entire population, according to the non-profit Kaiser Family Foundation. Many companies introduce changes to their health insurance plans during annual open enrollment periods in October and November.

To get discounts on premiums that are deducted from their paychecks, workers typically start by filling out a health assessment or participating in biometric screening, which usually involves body fat measurements and tests for things like cholesterol and blood sugar.

Employers then might offer another break for people who participate in a weight-loss program if they find, for instance, that they have an abnormal percentage of obese workers, said Chris Calvert, a vice president with the human resources consulting firm Sibson Consulting.

A 2010 survey by Mercer, a benefits consultant, found that 11 percent of companies with 500 employees or more that use a health risk assessment reduced the amount that workers pay for coverage if they completed one. That’s up from 7 percent in 2009. For companies with more than 20,000 employees, that figure rose to 22 percent last year from 15 percent in 2009. Mercer surveyed more than 2,800 employers nationwide.

Some companies move beyond the carrot and use the stick. Ten percent of the 996 employers that participated in Aon Hewitt’s 2011 health care survey penalized workers for smoking or showing no improvement in their body-mass index, a ratio of a person’s height to weight. A total of 46 percent said they might add these penalties in the next three to five years.

Penalties typically involve a higher deduction for health insurance from employee paychecks. Some companies also may limit insurance plan choices or require workers to pay higher deductibles, which are the annual amounts paid out of pocket before most insurance coverage starts.

For several years now, companies have offered cash or gift certificates to get employees to participate in health screenings. Many still do, but low participation rates have prompted more companies to switch in the past couple years to insurance cost breaks.

“Employers are saying we’ve tried the carrot and are not getting enough participation, so now we’ve got to apply a bit of the stick,” said Randall Abbott of the benefits consulting firm Towers Watson.

Companies typically hire a third party to run the programs, so the boss doesn’t see an employee’s personal information. That means the employer won’t know the worker’s body mass index, but it will know if he or she is entitled to a cost break because they participated in a program or improved their health measurements.

Still, the approach stirs privacy concerns.

“Anytime you’ve got that data somewhere, it can be accessed,” said Traci Stewart, as she was taking a smoke break in downtown Indianapolis on a recent Friday. Stewart, 40, said she would worry that her health insurance costs would rise because she smokes.

Last year, Indiana University — which has more than 17,000 full-time employees — offered three ways for workers to ease a cost increase for their benefits plans. They could complete a heath assessment, do biometric screening and sign an affidavit stating that they would not use tobacco or that they agreed to enroll in a smoking cessation class.

The assessment, in particular, drew criticism, said math professor David Fisher, one of the sponsors of the employee petition. He noted that it included a question about religious service attendance.

“They sort of seemed to have gone the extra mile to try to offend as many people as they possibly could,” he said.

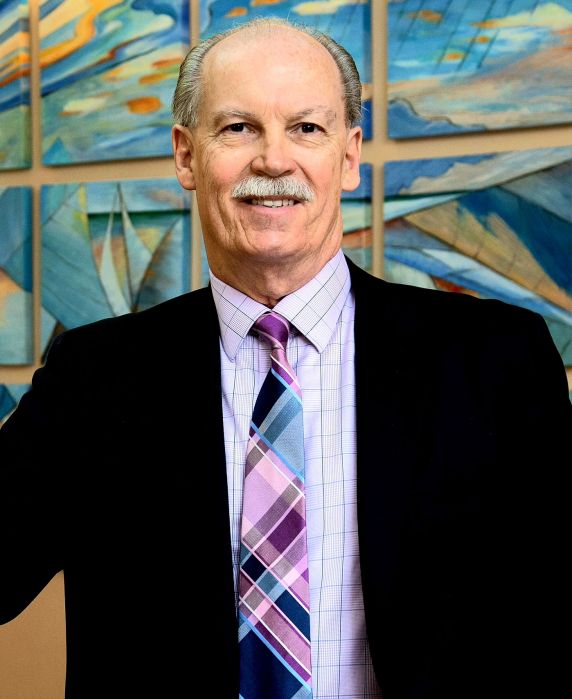

IU Chief Financial Officer Neil Theobald said in an e-mail that the assessment’s questions aimed to gauge an employee’s “support structures.” He decided to drop it after seeing the controversy it stirred, but the university kept the other programs.

James Ventress, 40, of Indianapolis, said he would have no privacy worries if his employer offered to trade a premium break for a health assessment. He said the screenings would help workers learn about their health.

“It’d help me out if they paid for it,” said Ventress, who installs floor coverings.

Benefits experts expect more employers to offer discounts for workers who agree to disclose health habits.

“We can talk about this being a cost-control issue, and it is. But the larger social issue is … we have a population that’s really unhealthy, and employers are in the vanguard of trying to engage people in getting healthier,” Towers Watson’s Abbott said. “Employers are insisting on greater accountability for personal health improvement.”

Copyright 2011 The Associated Press.