Thin margins require a delicate dance

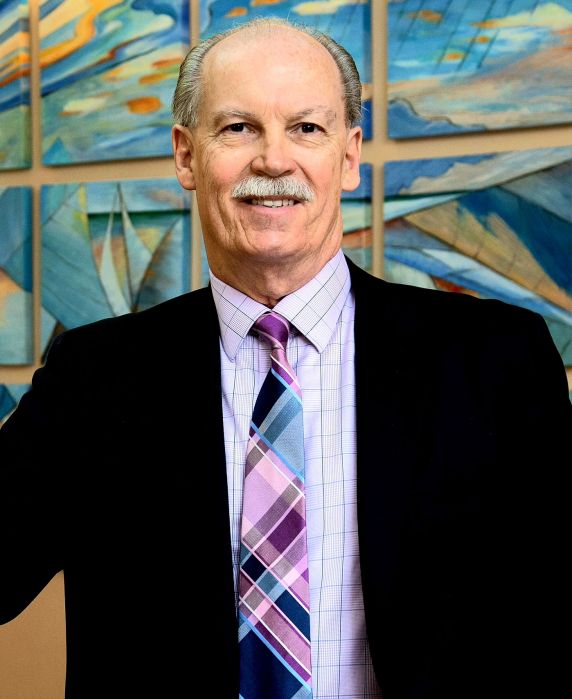

The Manhasset school budget development process has been underway for several months. A number of factors are putting significant pressure on this year’s budget, including health care and pension increases and the potential loss of hundreds of thousands of dollars in state aid. At the March 7 board of education meeting, Superintendent Passi gave the first of several informal budget presentations.

“We have crafted a budget that manages the complexities of a challenging financial environment. Our budget development goals include the following: support the district’s priority areas, preserve our strong academic programs K 12, expand academic offerings at the secondary school, maintain and upgrade our aging facilities infrastructure, enhance our instructional technology infrastructure and instructional software, bolster security staffing in all three schools, maintain and enhance support for the social and emotional wellness of our students and of course, operate within the property tax cap.

“We are committed to a fiscally responsible budget that reflects our commitment to operating within the allowable property tax cap. This year, our preliminary 3.3 percent budget to budget increase is within the 2.68 percent property tax cap. Over the past 15 years, the average levy to levy increase has been 2.11 percent. When viewed through the lens of steep rise in certain costs, such as benefits the last several years, this is an incredibly tight budget process,” Passi said at the meeting.

Budget Breakdown

The largest category of expenditures is staffing, both active and retired. “Staffing, not surprisingly, accounts for 75 percent of our budget, special education services, other than compensation, account for 5 percent of the budget, and 20 percent of our budget is made up of all other expenditures. Within that 75 percent includes compensation benefits and certain non-discretionary components that are dictated by our collective bargaining agreements.

This year’s budget increase includes active and retiree health care costs and pension contributions, all of which have percentage increases that are in double digits in a 2 percent tax cap environment. So 25 percent of the overall budget is benefits. Yet the increase in benefits takes up 36 percent of the ’24-‘25 budget increase. We’ve managed this impact in part with certain staff reductions, totaling a net impact of almost $800,000. This represents a minus 0.75 percent of the budget increase.”

Expenses

The expansion of course offerings, including more research time, engineering classes, and a Mandarin language pathway, are one area of increased expense. The equipment rotation is still in place to ensure the district does not have a technological cliff in future years. The school is bringing more professional development in house using staff literacy experts. Funding for curriculum development is also maintained. Facilities upgrades and maintenance are accounted for in this budget, as well as security recommendations from Nassau County Homeland Security. It also includes the servicing of the district’s debt and expanded wellness and mental health initiatives.

Changes to special education requirements have also added to costs. “The primary expense driver is the increase in the number of and cost of out of district placements. In addition, we’ve budgeted for the new unfunded mandate that requires us to educate special education students through their 22nd birthday; it was previously the 21st birthday. Our increase would have been less by $181,000 had this not been mandated. In addition, contract therapists provide services to students with an IEP that include assistive technology, occupational therapy, nursing services, auditory and visual therapy. The cost of these services increased 18 percent in ’23-‘24 and are budgeted for an increase of 11 percent in ’24-‘25. This represents a 30 percent increase over two years on a line item that now totals $1.8 5 million. So that’s a significant increase.”

Staffing reductions

A pilot program implemented last year, meant to streamline integrated special education in the classroom, will be adopted going forward. This restructuring is contributing to staff reductions. “This year we changed our elementary co-teaching model to include a special education teacher in classrooms throughout the day with the general education teacher. In the previous model, the special education teacher was in the classroom for two and a half hours a day, and the remaining part of the day was covered by a teaching assistant. This change reflects a best practice model. And given the overall positive feedback from our teachers we’re continuing this model next year,” Passi stated early in the presentation.

Later, the superintendent went into greater detail regarding the reassignments and reductions. “We examined our staff assignments with an emphasis on lowering class size primarily through achieving staffing efficiencies. We have added 3.0 elementary teachers to lower class size in grades five and six. We have added 2.5 secondary teachers to lower class size and support our curriculum expansion and manage increase enrollment in certain departments.

Given the challenging fiscal environment, we are recommending that 3.5 teachers on special assignment be returned to their classrooms to help them shore up the impact of the staffing additions I previously outlined. 4.1 Teachers are reduced due to student enrollment and efficiencies in scheduling.

The IT staff developer positions were originally expanded to support teachers with hybrid instruction. Since then they’ve trained teachers on (our) technology platforms. That training would revert to two other teachers and the director of technology, with respect to the assistive technology role; that position would revert to contract therapists from Nassau BOCES.

This change has led to a reduction of 10.0 budgeted elementary classroom TAs this year; we have 24 classroom TA positions budgeted, of which 22 are filled. Next year we’ll have 14 positions budgeted at the elementary level. As we discussed previously, the change in our ICT model, that’s our integrated co teaching model, has a special education teacher in the classroom now throughout the day. The model was piloted this year. The previous model had split support for students with disabilities between a special education teacher and a teacher assistant. Certain ICT classes will continue to have a teacher assistant based on the needs of a particular student or students.

It saddens us to recommend removing the elementary computer lab TA positions, the elementary library TA positions, the secondary school library TA position and one secondary school departmental TA. The remaining departmental TAs at the secondary school will be reassigned to ensure coverage for all departments.”

Revenue

Passi also broke down where the school district gains its revenue. Property taxes account for the lion’s share, at 90 percent, while state aid accounts for five. The other five comes from the appropriated fund balance and other sources.

“We received from the Office of Real Property Services a growth factor that tells us the value by which the tax base in the community has been adjusted as a result of construction. New construction this year is valued at $349,000 and was factored into our tax cap.

We expect to see an increase in revenue from boundary properties by $45,000. Interest earnings are projected to increase by an estimated $525,000. And sadly, the governor’s proposed budget includes a reduction of $629,000 in foundation aid for our district which as I said before, represents a stunning 20.7 percent decrease in Foundation Aid. This is because the governor’s budget includes two significant revisions to Foundation Aid.

A reduction in the inflation factor used to update the formula each year and the elimination of the current safe harmless provision of the formula the state legislature is set to vote on the governor’s proposed budget on April 4.” Passi said.

The budget assumes the restoration of state aid. Should the restoration not occur, the district plans to appropriate the difference in fund balance.

The budget situation is delicate. “We are recommending an increase in the assigned fund balance to remain within the property tax cap. This is opposed to impacting our educational program with incremental reductions. The risk is that the ’24-‘25 budget must produce the same amount of fund balance for sustainability moving forward to ’25-‘26.” Passi said at the conclusion of his presentation.

Beginning April 22, early mail applications will be available on the Manhasset school district website under the Board of Education voter information tab. Early mail-in ballot applications must be received by May 14 by the Manhasset district clerk. The next informal budget hearing will be on March 21, followed by another informal hearing April 4. The board is set to adopt the budget on April 16. The formal budget hearing, as is required by law, will be on May 9, and the annual budget vote is scheduled for May 21.