Northwell Health transforms lives through healthcare daily. Along the way, it’s also been transforming many buildings in Long Island and beyond in what is likely one of the region’s more under-reported healthcare stories: how New York State’s biggest healthcare system has been expanding, buying, owning and building to suit numerous highly regulated and precise needs.

In possibly Northwell’s biggest real estate transformation, it turned 1.4 million square feet at 1111 Marcus Ave. into a sort of medical mall. The building that once housed the United Nations and then Sperry Rand is now honeycombed with healthcare offices and services.

“We were very thoughtful about where the medical pieces of the building are, versus some administrative stuff. The medical pieces of the building are located closer to the parking,” Northwell Vice President, Real Estate Strategy and Finance Thomas Nappi said. “To me, that’s a fascinating transformation. That building was very much a non-clinical building. We have been and continue to put clinical care in that building.”

That building is slab on grade, which made it easy to position heavy equipment without reinforcement.

“We took a thoughtful approach to the patient experience,” Nappi said. “We do due diligence and homework before executing on a transformation or transition to clinical care.”

They recently continued their real estate expansion, acquiring a more than 300,000-square-foot, vacant office building at 200 Jericho Quadrangle built in 1982. It was leased to Cablevision and its successor Altice USA, but was vacant for two years.

“Northwell Health is currently considering options to develop the property in Jericho for health care services to meet the evolving needs of Long Islanders,” the system said in a written statement. “We look forward to more engagement with the community as we move forward with the project.”

Meanwhile, in New York City, Northwell is seeking to move ahead with a $2 billion expansion and modernization of Lenox Hill Hospital.

The system would convert rooms to larger, single-bedded units, increase the number of beds by 25 to 475, expand the emergency room and build a special unit for mothers and newborns.

“You have to keep up with the changes in health care,” Northwell Chief Medical Officer Dr. Jill Kalman told Crain’s New York. “It needs a new hospital for that.”

While Northwell has made its mark on thousands of lives, it also made (and continues to make) its mark through much more than medicine. With 28 hospitals, more than 100,000 employees, more than 1,000 outpatient facilities and more than 16,000 affiliated physicians, it’s an important player due to its size and scope.

The system already has breathed new life into so many buildings, including turning an old grocery store in Bay Shore into a cancer center.

“When we think about our portfolio, we look at how we’ve grown over the last 25 or 30 years. We’ve grown by buying hospitals,” said Nappi. “But we also expand, by bringing on new doctors. There is expansion by acquisition and more organic.”

Although some healthcare has moved to virtual, and technology is key, Nappi said “healthcare at this point is very much face to face.” And Long Island real estate isn’t cheap.

“It is Long Island and prices remain fairly high,” Nappi said. “We as an economy had inflation higher than historical inflation. That has not reversed itself, although inflation has come down.”

Many buildings are 100 years or older, and Nappi said, the system is “selective” as to what they acquire or lease. Since Northwell is a nonprofit, it doesn’t typically pay real estate taxes to buy properties.

“When we’re a lessee, the real estate taxes are borne by the landlord. I think it’s helpful to us as a health system,” Nappi said. “I would argue it’s probably even more important and helpful to the patients.”

While Northwell owns and operates dozens of hospitals, those facilities are only part of its real estate story.

“We have a very robust ambulatory network. You see Northwell signs all over,” Nappi said. “Everything we do is focused on patient experience and care. To be where patients live.”

With hospitals being reserved largely for much more physician,-intense, longer stay treatments, Northwell has been busy gobbling up large and smaller spaces.

“We’ve been very active in expanding our ambulatory network to feed hospitals. That’s where we see continued growth on Long Island, a market where we think we’re well represented.”

Growth, possibly ironically, includes but extends far beyond hospitals. “The technology and treatments are changing,” Nappi said. “A lot of treatments are going to ambulatory surgical centers, being treated outside of hospitals.”

Nappi said they have large campuses and “the other piece of the portfolio tends to be much smaller.”

“We like to have high visibility. Parking is always very important,” Nappi said. “People tend to drive to see their doctors.”

They often deal with the same landlords and sometimes rent, because not all property is for sale. “It depends on the strategic value for us,” Nappi said. “What we put into the practice and the building.”

The presence of empty big box stores created another option for Northwell’s growth. “I think the emergence or availability of some big box stores presents an opportunity in the right markets for healthcare providers,” Nappi added. “We also like to look at high quality properties.”

An aging population fuels growth. Still, different uses mean different needs. Imaging buildings have to be well supported, because equipment is heavy. Surgical centers need a certain ceiling height so equipment fits. “It really is specialty dependent,” Nappi continued.

While Northwell has largely expanded in Nassau, and even out of state, the system also is expanding eastward.

“It feels to me like there’s more potential for growth in Suffolk,” Nappi said, noting South Shore University Hospital and Peconic Bay Medical Center as examples. “We were historically a Nassau-based system. I think we have a little bit of growth catching up to do.”

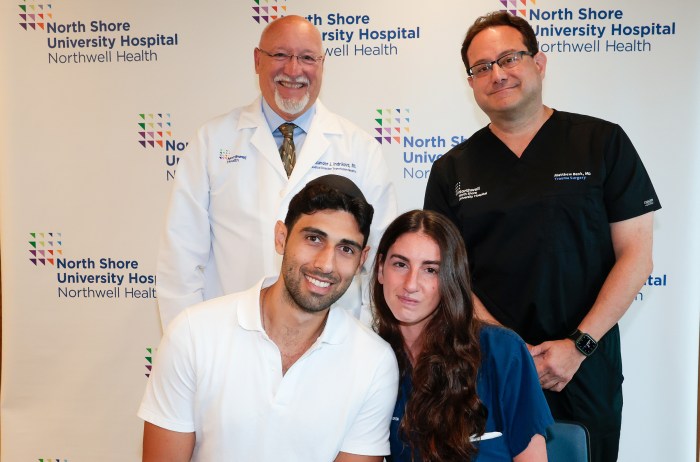

They typically hire builders, although they sometimes do minor refreshes on their own. A large construction management company oversaw the construction of Petrocelli Pavilion, a large surgical annex that opened last February at North Shore University Hospital.

Philanthropy pays for a lot of the construction, but they sometimes use the Dormitory Authority of the State of New York. “It’s project specific,” Nappi said.

Housing remains an issue for Northwell as it seeks to hire, expanding beyond the 100,000 mark.

“We need more housing on Long Island,” Nappi said.

While Covid led to a flight from the office, there is a return to the office, but healthcare has largely been immune to the vacillations of a virtual and brick-and-mortar economy.

“Historically, the real estate market, education and healthcare, were more recession proof than other niches or facets of the market,” Nappi said. “I think there continues to be an expansion in the tristate area of healthcare systems. We’ll continue to acquire new space.”