Long Island business owners are under siege. The culprit isn’t just rising rents, shifting shopping habits, or the lingering effects of the pandemic. It’s something less visible but equally damaging: skyrocketing car insurance costs.

Most people think of car insurance as a commuter issue. But for small business owners, it’s an escalating expense that touches every part of their operations – from owners and employees to delivery drivers, vendors, and customers. I’ve seen it firsthand, both as a business owner and as president of a local chamber of commerce.

I recently transitioned my brick-and-mortar boutique to an online-only business. Costs kept climbing while both foot and car traffic dwindled. I’m not alone in this battle. Across Long Island, small businesses rely on vehicles to function – vans to deliver goods, trucks to move inventory, and cars for sales calls or customer visits.

When auto insurance premiums surge – what once cost a few hundred dollars now runs into the thousands – these daily operations become unsustainable. Business owners must either absorb the costs or pass them along to customers already stretched thin. No one wants to do that.

And these costs are rising faster here than almost anywhere else in the country.

According to Bankrate, New York drivers now pay an average of $4,031 a year for full coverage – far above the national average of about $2,400. Even minimum coverage can cost $1,700 to $2,700 annually, more than double the national average of $800 to $1,000. This year alone, New York drivers are facing an average 13.5% increase in premiums — among the steepest hikes in the nation. By comparison, the national average increase is around 7%.

For working families, that translates to about $333 a month – roughly the cost of a week’s groceries for a family of four, 100 school lunches, or a year’s worth of school supplies. When car insurance rises faster than wages, rent, and groceries, New Yorkers are forced to make impossible trade-offs. Some lower-income drivers delay renewals or reduce coverage, while others drive uninsured – putting themselves and others at risk.

Businesses feel these ripple effects. Since the pandemic, insurers have pointed to excessive litigation, rising claim costs, and rampant fraud as reasons for rate hikes. Wholesalers raise prices to offset their own premiums. Delivery drivers face higher costs to stay insured. And store owners – already squeezed by inflation – find themselves footing yet another bill.

The connection between car insurance and business survival may not be obvious, but it’s undeniable. New York’s outdated legal environment has allowed staged accidents and fraudulent injury claims to thrive. Insurance companies, burdened by excessive litigation and high payouts, raise premiums across the board. For small business owners operating on razor-thin margins, that can be the breaking point.

The strain is real – and it’s growing.

State leaders must act. Albany should take a hard look at laws that enable bogus lawsuits and fraud to flourish. Reform should also mean encouraging competition, making it easier for new insurers to enter the market and drive costs down. And just as importantly, it’s time to modernize outdated regulations that keep premiums artificially high. Without state intervention, more local shops will shutter, deepening the loss of community anchors and expanding food deserts across Long Island.

Elected officials often call small businesses the lifeblood of our communities. But that lifeblood is being drained by out-of-control car insurance premiums. Governor Kathy Hochul must take decisive action now – to reform car insurance statewide, support small businesses, and protect the communities that depend on them.

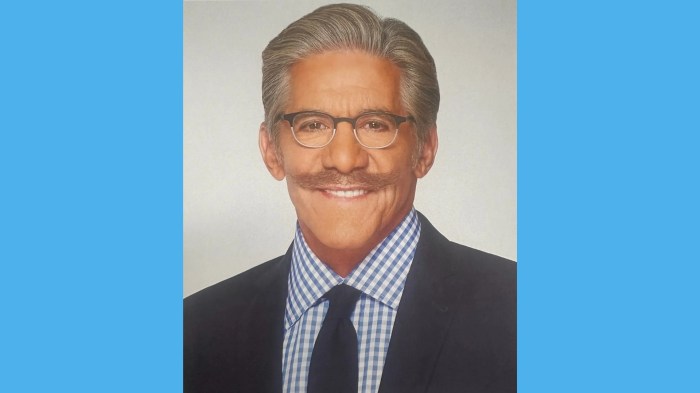

Sagine Charles Pierre is a small business owner and Board Member of West Hempstead Chamber of Commerce