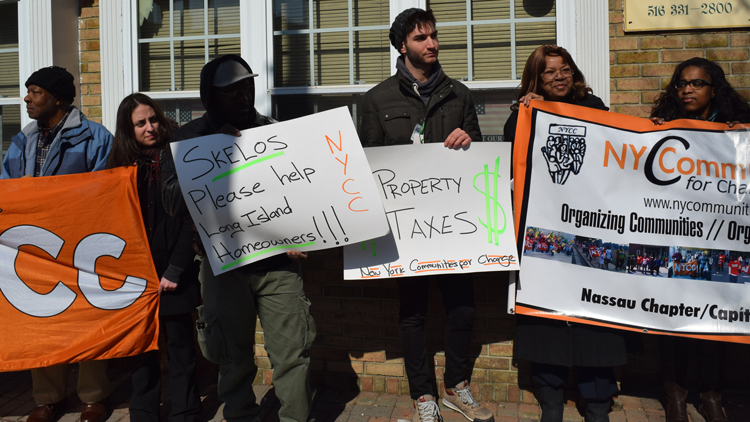

More than a dozen protestors rallied outside New York State Senate Majority Leader Dean Skelos’ district office in Rockville Centre Wednesday demanding the end to a controversial tax abatement program intended to foster affordable housing that instead also benefits some of the ultra-wealthy.

Carrying signs and shouting chants including “Help Homeowners, Not Millionaires!” demonstrators held a press conference on the sidewalk, voicing grievances ranging from multi-million-dollar savings for billionaire tenants of an uber-posh penthouse tower in Manhattan to the exorbitant property taxes paid by low- and middle-income families across Nassau and the state.

“He’s got his priorities screwed up,” slammed Hempstead resident and Long Island Chapter President of nonprofit New York Communities for Change Diane Goins, of the 16-term lawmaker. “We’re here to change his mind.”

Known as the 421-A program, the scheme grants property tax exemptions for developers if construction of multi-family residential buildings affects their property values, with varying benefits based on location, property use and affordable housing requirements. It’s designed to incentivize more affordable housing development in New York City, yet has come under fire in recent months and weeks, with critics citing massive tax breaks for wealthy developers, luxury condominium owners and deep-pocketed political campaign donors, financed on the backs of the very taxpayers the program was originally intended to assist.

Case in point: One57, a 75-story luxury skyscraper on West 57th Street—one of several comprising a stretch known as “Billionaires’ Row.” Units at the monolithic glass-walled spire with breathtaking penthouse views of Central Park sell for tens of millions of dollars; the prime minister of Qatar dropped a reported $100 million for a single penthouse last month and set a New York City record. Yet the building’s developer, Extell Development Company, was granted equally monolithic tax breaks under the 421-A abatement program—at least $35 million worth, according to reports—and prompting an investigation into the arrangement by U.S. Attorney Preet Bharara, according to the New York Post.

“Right now 421-A is servicing billionaires and millionaires,” lamented Dennis Jones, of Hempstead, toting a homemade poster reading “Long Island Property Taxes” featuring a large frowny face emoticon. “We are now on Long Island considered the most expensive place to live in the country,” he explained, adding that he pays $16,000 in property taxes.

“Help homeowners, not millionaires!” he shouted.

Aida Rowe, another Hempstead resident protesting outside Skelos’ office, told news crews she forks over $14,000 in annual property taxes and said demonstrators were there to persuade the Republican lawmaker “not support 421-A when it comes up for reevaluation” in June.

“We must speak out,” she contended. “Our taxes on Long Island, in Nassau Country, are exorbitant.”

Goins, Jones, Rowe and their dozen or so fellow demonstrators aren’t alone in decrying abuses of the program. In November 2014 state Attorney General Eric Schneiderman announced settlement agreements with a New York City landlord and three developers as part of an ongoing investigation by his office targeting such improprieties. Perversion of 421-A by elected officials is also predominant allegation in the U.S. government’s criminal complaint against disgraced former State Assembly Leader Sheldon Silver (D-Manhattan)—who was arrested on federal corruption charges on Jan. 22.

An investigative report released Tuesday by The Hedge Clippers—a project supported by the Strong Economy for All Coalition, an alliance of community groups and labor unions working to fight income inequality—discovered, among other revelations, that while low- and middle-income residents are forced to dole out hefty property tax bills in counties across the state, the wealthy tenants of One57 enjoy a 95-percent tax slash.

“How much of a subsidy are One57 residents getting?” asks the group on its website HedgeClippers.org.

“So far, more than one billion dollars of condos have sold at One57, with the average sale price of $26.1 million. Yet the average owner will pay a mere $5,230 in property taxes this year. In total, the forty-four identified sales [as of 2/18/15] will pay a combined $230,138 in property taxes, saving a collective $4,774,029 from the 421a abatement, for this year alone.”

“And all that is before taking into account how massively under-assessed these condos are,” the Hedge Clipper report continues. “The average One57 condo has an estimated market value of just 8.73% of its sale price. That means that the 4,483 square foot condo purchased by a shadowy Hong Kong front company for $30mn has an estimated property value of only $2,177,857. Over the life of the 421a exemption, New York tax payers will lose out on an estimated $35 million.”

For comparison, if the very same tax credits enjoyed by One57’s tenants were extended to a family living in a $400,000 home on the South Shore of Long Island, the group calculates its new 421-A tax rate would be $430. The estimated $35 million subsidy for these billionaires, suggests HedgeClippers.org, could instead pay 458 public school teachers’ salaries, fund a year of universal pre-K for 3,418 New York City children, or even house 930 homeless families in New York City for one year.

The group identifies some of One57’s “super wealthy” tenants as billionaire hedge fund barons, CEOs and healthcare specialists. It also discovered that 421-A developers who received incentives were big campaign donors to politicians with sway as to which projects and developers get the abatements—contributing $2.98 million to state races since 2008, according to HedgeClippers.org—“including $295,000 directly to Andrew Cuomo. Extell Development, who built One57, contributed $100,000 directly to Cuomo on the very day that the tax breaks were announced,” the group states.

It’s revelations such as these that get protestors Phyllis Pruitt and Paul Merkelson’s blood boiling.

“Stop taking advantage of me!” blasted Pruitt, also of Hempstead, outside Skelos’ office. She said she pays $17,900 in property taxes.

“We should be able to use tax money to build affordable housing, not luxury housing,” slammed Port Washington resident and father of two Merkelson. “The housing situation here is in crisis.”

With media cameras in tow, they and others marched into the majority leader’s office to sufficiently express and relay their demands, flooding its narrow adjacent hallway and attracting the presence of several Rockville Centre police officers.

Skelos was not on the premises, a visibly shaken aide told them, declining a formal comment.

“I will pass along your messages to the senator,” he repeated to each appeal.

“We’ll be back,” Goins promised on the way out.