Nassau County has not raised the property tax levy for four consecutive years. The proposed 2014 budget again contains no property tax increase. The critics, rather than applauding the fiscal improvements in the County, elect to sling mud and make false and malicious allegations.

In a letter to former county comptroller Howard Weitzman, the County Attorney’s office, represented by a securities attorney, warned him that allegations in his letter of Sept. 16, 2013 regarding the Nassau County’s 2012 budgetary results, were “patently false and alarmist with potential to harm the County taxpayers by seriously affecting the County’s ability to obtain financing.” The allegation that the County Comptroller has mischaracterized the accounting treatment of $88 million in court ordered payments and that the County has somehow manipulated the Supreme Court order are ludicrous.

As a CPA, the former comptroller is well aware that the County’s 2012 Annual Financial Report is fully audited by outside auditors (the same auditors originally hired by the former comptroller) in accordance with generally accepted accounting principles. The financial reports are further reviewed and confirmed by the independent and non-partisan Legislative Office of Budget Review and closely monitored by multiple rating agencies and numerous regulatory authorities. The accounting of the $88 million is fully disclosed and properly booked consistent with generally accepted accounting principles.

The County’s $41.6 million budgetary surplus in 2012 was achieved by controlling expenses, refinancing debt at lower rates, imposing a nonessential hiring and wage freeze, and challenging property tax grievances. The economy has also helped by increasing sales tax revenues.

Although the County manages and reported its $41.6 million 2012 surplus on a budgetary basis, it also reports its year-end results in additional accounting methods as required by various regulatory organizations. In every accounting standard, the County financial performance has improved since 2009.

Year End Financial Results on GAAP basis (150 percent better)

Year End Results on NIFA basis (54 percent better)

Fund Balance (money in the bank) (35 percent higher)

Structural Deficit (80 percent better)

New Borrowing in 2006-2009 vs 2010-2013 (49 percent lower [better])

The point is that the Nassau County financials have stabilized and strengthened over the precarious state they were in 2009 and as a result property taxes have not had to be raised in four consecutive years. The proposed 2014 budget again contains no property tax increase for our hard pressed taxpayers, which is the best indicator of the improved financial condition of the County.

To see the numbers for yourself, the County 2012 audited financial statements (the 2012 CAFR) are publically available on the Comptroller’s website at www.nassaucountyny.gov/agencies/comptroller/index.html

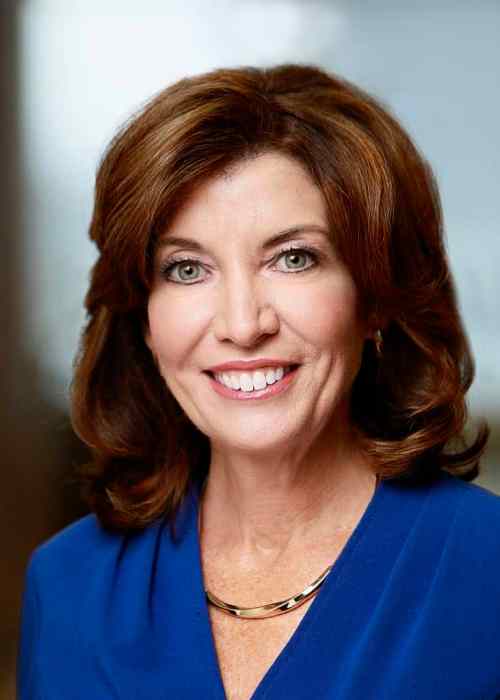

– George Maragos, Incumbent Nassau County Comptroller