By Madeline Singas

The ever-growing problem of identity theft impacts thousands of Americans annually.

Last month, my office took down one of the largest identity theft rings ever on Long Island. Five individuals allegedly operated a highly sophisticated operation that stole hundreds of identities in an attempt to steal nearly $1 million.

Personal data — your financial DNA — has tremendous value for such thieves. With a few data points, a criminal can build a credit profile and use that information to acquire loans in your name.

In this case, the alleged mastermind, who owned a credit repair service, utilized publicly available lists of employees of school districts, medical institutions, and other organizations. He assumed that they were persons of means or had good credit scores. Using those identities, he allegedly purchased information on more than 500 identities on the dark web for approximately $4 per identity.

Using that and other information, he then ran credit reports in those names to verify their creditworthiness. If the victim’s credit was better than 680, he then used their identities to apply for loans at a credit union.

Thankfully my office, with assistance from the U.S. Postal Inspection Service and local credit unions, stopped these defendants before they did more damage to unsuspecting victims.

Our easy access to credit cards, online banking, and mail-order retailers has made our world more convenient. It has also made us more vulnerable to identity theft.

Often, you may not be aware that someone has stolen your identity and used it to commit fraud, typically by falsifying your credentials to open new accounts in your name or by using your existing accounts.

So how can you protect yourself and your loved ones from being a victim of identity theft?

The dedicated financial crimes professionals in my office advise people to order a free credit report at annualcreditreport.com or by calling 1-877-322-8228. The Fair Credit Reporting Act requires that each of the three major nationwide credit reporting companies provide you with a free credit report, at your request, once every 12 months.

Obtaining your own credit report doesn’t affect your credit score. By requesting one of the three reports every four months, you can see the status of your credit on a continuing basis.

We encourage people to not only look at what credit has been extended, but also which inquiries/applications have been made in their names.

The earlier you catch an irregularity on your credit report, the earlier you can rectify it and hopefully prevent fraud.

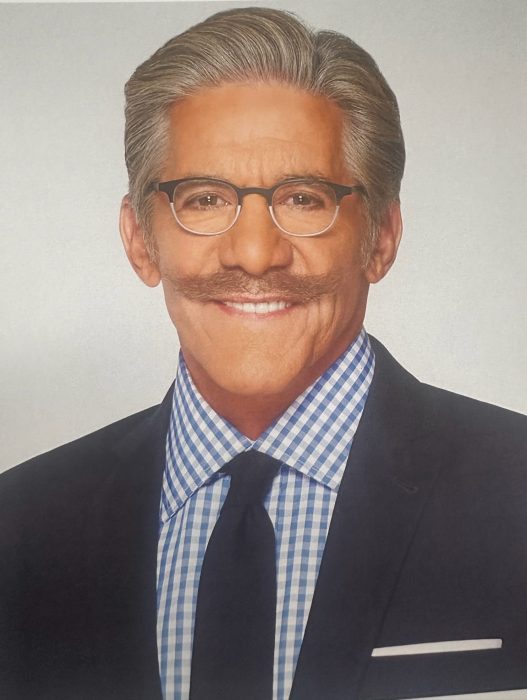

Madeline Singas is the Nassau County District Attorney. If you believe you may be a victim of identity theft, contact the Nassau County District Attorney’s Financial Crimes Bureau at 516-571-2149.