After eight years, the Mangano administration’s frozen property tax assessment roll has officially come to an end, as I fulfill my promise of fixing the broken system and restoring integrity to our tax rolls.

The previous administration left us with more than $500 million in liability from property tax grievance settlements due to inaccuracies. There was never a plan to address this mounting debt accumulating from the broken system — until now.

For the past eight years, homeowners who successfully grieved year after year shifted the tax burden onto those who didn’t. The inherently unfair system gave grievers a more favorable ratio and almost guaranteed a reduction. This ends with the final Mangano roll of 2019-2020.

After eight years of paralysis, we took action and completed the first reassessment of more than 400,000 properties. Nassau does not get one extra dime from the reassessment, but we are ending a system where one half of taxpayers subsidized the other half.

The Nassau County Assessment Review Commission (ARC) has sent final determination letters to property owners who filed grievances on the county’s 2019-2020 tentative assessment roll, which was published on January 2, 2018. Residents and other property owners will receive bills based on this roll in October 2019 for school district taxes and January 2020 for county, town, and special district taxes.

This is also the last year for ARC’s mass-settlement program, which was an unfortunate by-product of the frozen roll. To date, for the 2019-2020 tentative roll, ARC has made 203,732 residential settlement offers, of which 174,281 were accepted and 20,437 were rejected. Of these offers, 127,459 were part of the mass settlement program.

Just from settlements this past year, the county lost more than $7 billion in market value and $20 million in assessed value — in a rising market. This significant loss of property value countywide was driving up school tax rates. Having a lower assessed value means you need a higher tax rate in order to get to the budgeted tax levy amount for the school district.

This ends now.

The 2020-2021 tentative roll that was published on January 2, 2019 used updated market values from the reassessment that I ordered when I came into office. As a result of the accuracy of the reassessment, ARC will verify and most likely concur with the class ratios published by the assessment department, which will negate any cause for mass settlements.

I want to assure residents that you will always have the right to grieve, but you shouldn’t have to do so to obtain a fair assessment of your home.

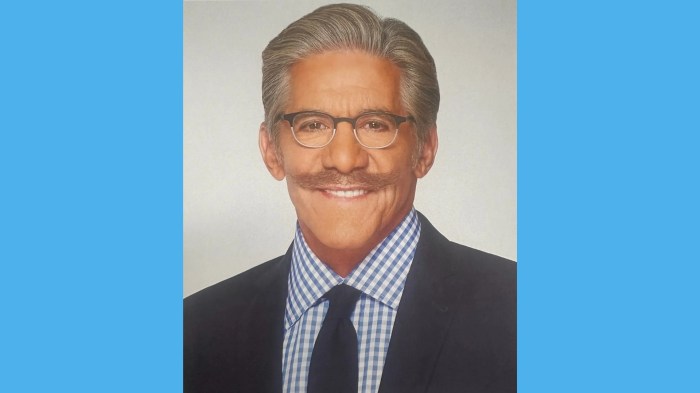

Laura Curran is the Nassau County Executive