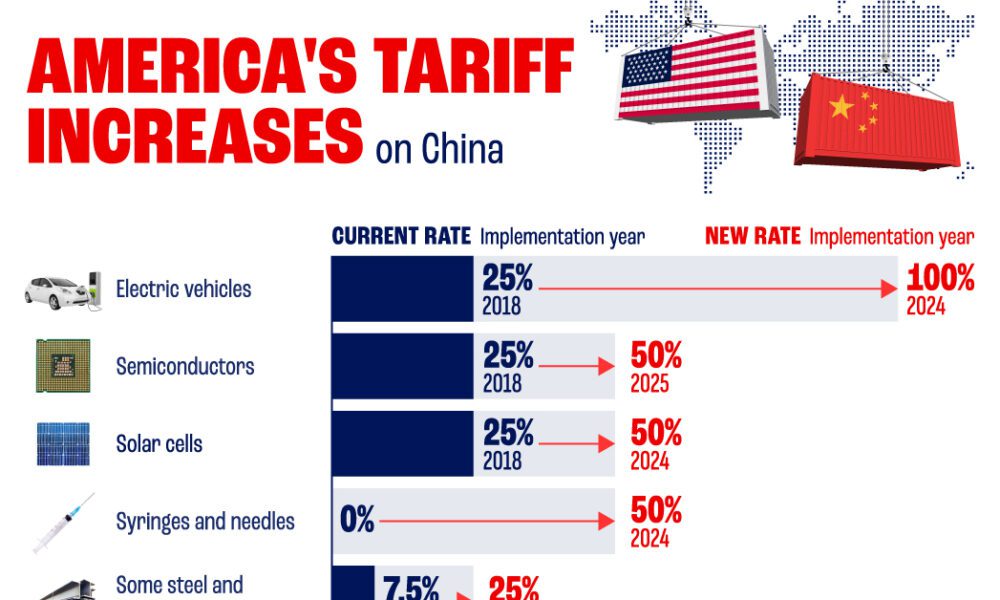

Unless you’re not a big TV watcher, or get your news on the net, or read, the tariffs that President Trump has initiated are having devastating and tumultuous effects on our markets here and abroad.

The price of almost everything is and will be increasing as businesses have to adjust their prices in line with their costs to survive and still be profitable.

Is this really the “no pain, no gain” scenario that Donald is pushing us toward? The stock market, just today, as I write this column at 11:26 AM EST is down 1,084.02 (-2.29%) to 39,471.98, the S&P is down 169.98 to 5,226.54 (down -3.15%).

By the end of Friday, April 4, the Dow was down 2,231 points at 38,314.86, and the S&P was down 322.44 at 5,074.08. It’s been a rough and wild ride the past week, and there is no end in sight if these tariffs continue.

The world markets are in turmoil, uncertainty, and fear, and the costs to consumers will be monumental, especially for the purchase and/or leasing of cars, with prices rising from $5,000 to $15,000 (https://www.freep.com).

The ironic fact is that the effect will mostly hit many of those consumers who can least afford the devastating effects of increased prices and who voted for Trump.

The autoworkers think and believe that the tariffs are a good thing. Republican strategists generally argue that tariffs create good jobs, increase economic growth, and decrease trade deficits, as noted in Council on Foreign Relations

Unfortunately, it has been proven that it would take businesses 5-10 years to construct the necessary infrastructure for those jobs.

But more crucial is that our wages average $30 per hour as of mid-2024, while those in China are $7 per hour and even less in other developing countries. This huge spread between the country’s labor costs translates into more economical prices for consumers today and better profits for corporations.

Lastly, bringing jobs and businesses back, for the most part, will never happen, and the current tariffs imposed will never solve our problems. What it will do, as history and economists have shown us time and again, is increase the public’s costs of goods and services and inflation across the board and reduce the possibility of creating future wealth for the majority of American citizens.

Here is some history to help you understand a bit of our predicament.

From 1789 to 1934, tariffs were supposedly used to protect American industries and businesses. But my thoughts are that this was specifically used to raise money to run our government. I am not convinced that it had as much to do with protecting our economy, and initially, maybe that was the intent.

However, to me, this was another form of “cash-grabbing,” as I would call it today, against other countries. https://www.cato.org

Free trade, for the most part, has always been a better path to pursue, a method that would keep the quality and quantity of goods flowing in a more seamless fashion with fewer bottlenecks and supply chain shortages.

This would create fair and equal competition as to who could produce the quality and quantity of all goods for the globe to consume in a way that would benefit the masses. But today, it’s not about benefiting the people but benefiting those corporations that only care about profits instead of balancing their bottom lines with the quality and quantity that consumers surely need and want.

The real problem is that other countries are imposing tariffs on our goods instead of educating their population to compete with our workers, to produce quality products, and to pay their workers a fair wage, which is the greatest discrepancy in our competition with them.

The income tax was initially created by Abraham Lincoln and passed by Congress in 1862 as the Revenue Act of 1861 to cover the Civil War expenses incurred during that horrendous and incredibly sad time in our history. Real estate taxes and import tariffs were also levied.

A minimum of $50 million was needed to fund the war. Taxes levied were anywhere from 3% from $600-$10,000 of income, then from $10,000-$50,000 at 5% and over $50,000 at 7.5%.

However, this raised $350,000,000 to pay for the costs of the Civil War. Due to the backlash and unrest caused by this tax, it was repealed in 1870.

On February 3, 1913, the 16th Amendment was created, allowing Congress to levy a federal income tax on all incomes. For more information, check out: https://www.reaganlibrary.gov

Finally, the big $64,000 question is whether or not the tariffs, as they currently continue, will have a major long-term effect on our real estate industry, including sales, investments, purchases, rentals, and leases of residential and commercial properties.

Looking at the path of the stock market over the last two weeks, I think that it will. The losses and psychological effects of how consumers react just might have a dampening effect on our real estate in many parts of the U.S.

For those who have the money, credit, and cash to pay, it probably will not have as much of an effect. But as inventory grows and demand cools just a bit, more negotiations on higher-end properties will ensue as they will take longer to sell.

Philip A. Raices is the owner/Broker of Turn Key Real Estate located at 3 Grace Ave Suite 180 in Great Neck.

For a free 15-minute consultation, value analysis of your home, or to answer

any of your questions or concerns he can be reached by calling (516) 647-4289

or by email: Phil@TurnKeyRealEstate.Com and you can search properties at your leisure and convenience at: https://WWW.Li-RealEstate.Com