When Gary Winnick died a few years ago in his Los Angeles home, the Los Angeles papers talked about him as a longtime Los Angeles resident. Once the richest man in Los Angeles, he was also the architect of Global Crossing, which became one of the nation’s biggest bankruptcies. He appeared to be a broke billionaire, innovator, risk taker, winner, loser and philanthropist.

But Gary Winnick was also a Long Islander who never entirely left the region.

He was a Long Islander by roots, education, entrepreneurship and, of course, philanthropy.

Winnick grew up on Long Island, attending Roslyn High School and then C.W. Post, now part of Long Island University, to which he continued to donate. A bundle of contradictions, he was widely seen as generous, despite presiding over a bankruptcy that lost investors millions. He had more business lives than a cat: If a cat had nine, Gary Winick had 10. After all, “win” wasn’t his middle name, but it was part of his name.

“Success is not about you,” Long Island University quoted him as saying in 2015. “It’s about the good you can accomplish.”

Someone who made money from the company that would become among the nation’s biggest bankruptcies, Winnick always seemed to land on his feet. “I have no apologies for anything,” he said in 2016, after founding his family office investment firm Winnick & Co.

After he died, though, it came out that he had been a broke billionaire, borrowing so much that he left behind the legacy of debt where everything, even a wedding ring, was collateral.

“His 79-year-old widow, Karen Winnick, is now fighting to keep control of their homes, art and jewelry, all of which Gary put up as collateral against a massive loan,” The Wall Street Journal wrote recently.

Gary Winnick was born on Oct. 13, 1947, in New York City, surrounded by entrepreneurs, including a grandfather who sold restaurant supplies and another in the garment business. His father, Arnold, died when Winnick was 18.

“This event profoundly shaped Mr. Winnick personally and professionally,” according to his obituary on Legacy.com.

After Winnick graduated from Roslyn High School and C.W. Post, he joined the National Guard and worked in his brother-in-law’s furniture business.

Winnick married Karen (Binkoff) in 1972, working for Drexel Burnham Lambert, before they moved to California, where he worked with Michael Milken, who set up Drexel Burnham Lambert’s junk (high yield) bond business in Beverly Hills.

Milken would plead guilty to Securities and reporting violations (and eventually be pardoned), but Winnick was never implicated or faced charges.

He raised $20 million in 1998 to launch Global Crossing, which laid more than 100,000 miles of fiber optic cable across the Atlantic and 70 nations. By 1999, the company was valued at nearly $50 billion, including about $6 billion for Winnick’s holdings, according to the L.A. Times.

“It was fast and furious,” the Journal quoted Romeo A. Reyes, who covered Global Crossing for Jefferies and Co. “The hype was off the charts.”

Forbes in 1999 ran an article with the headline, “Getting Rich at the Speed of Light,” about Winnick and the company with only 200 employees,

“All these new Internet companies would go raise money, then spend $10 million buying capacity from Global Crossing,” Reyes told the Journal. “Then, the music stopped.”

Global Crossing filed for bankruptcy in 2002 with $12.4 billion in debt. Winnick, however, walked away wealthy after selling more than $730 million in Global Crossing stock between 1999 and 2001, according to the Journal.

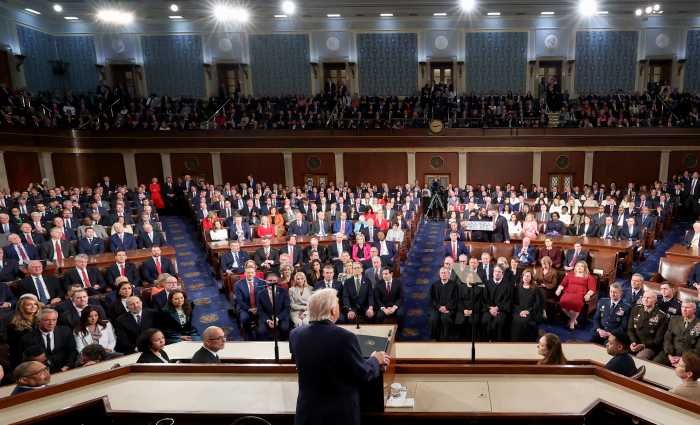

“Yes, I made a lot of money,” Winnick told the House Energy and Commerce Committee. “But when I went into this venture, building a cable across the Atlantic, I had no contemplation that this thing would turn out to be what it was.”

The company faced investigations of accounting fraud, possible insider trading, and gilding the lily, by convincing investors that things were better than they were.

Leaders of some big public companies that went bankrupt around that time went to jail, such as Bernard Ebbers of WorldCom and Kenneth Lay and Jeffrey Skilling of Enron.

Winnick was never charged with wrongdoing, but contributed $25 million to help employees who had invested their pensions in the company, and settled a shareholder lawsuit for $55 million without admitting guilt.

Despite a big bankruptcy and some good and bad investments, Winnick was known as a voluble, likeable person, a true salesman down to the soul, a talker, storyteller and jovial man.

“I used to meet Gary at the grand Havana room for a light lunch or afternoon snack. Every time he would say I have an hour, and I have to go,” Lenny Sands wrote on Legacy.com’s obituary. “Four hours and 10 stories later, I would leave with a smile on my face.”

Winnick became known not only for companies but causes.

Timothy Davis, of the Greatest Generations Foundation, said Winnick “passionately supported the veterans of our nation,” such as The Greatest Generations Foundation and the veterans it assists.

He would say he was at best ambivalent, but not ashamed, of Global Crossing’s rapid rise and fall. “I am both proud and I am saddened by it,” he said.

He remained married to Karen Winnick, chairman of the Los Angeles Zoo Commission and a children’s book author, for more than 50 years, and they had three children and eight grandchildren.

They in 1994 for $94 million acquired and restored the 40,000-square-foot, 60-room estate known as Casa Encantada in Bel Air, Log Angeles.

Winnick and companies such as Global Crossing donated hundreds of thousands to Democrats and Republicans, but Winnick also borrowed big, seeking a $100 million revolving line of credit from CIM Group in 2020, which the Journal said was backed by a massive mansion known as Casa Encantada, their Malibu home, art, and jewelry.

In June 2023, the Journal reported that the Winnicks put Casa Encantada up for sale for $250 million, before he died in that home on November 4, 2023, at the age of 76.

“In the weeks after his death, Karen claims she learned about the terms of the loan and all of the assets pledged as backing for it, including her wedding ring,” according to the Wall Street Journal.

After a default on payments, CIM sought to foreclose on Casa Encantada and the Malibu home, although the Journal reported Karen Winnick obtained a stay from a court of appeals

The Winnick Family Foundation, founded in 1983, has done a great deal of good. In 2000, Winnick won the Simon Wiesenthal Center’s Humanitarian Laureate Award and was subsequently awarded an honorary doctorate from the C.W. Post campus of Long Island University.

A painting of George Washington commissioned by Benjamin Franklin became part of the Winnick collection. Yet in the end, Winnick used assets, including the wedding ring, to borrow, as a man who lived large and, it turns out, borrowed even bigger.

“What does surprise me a little bit is that the dude knew leverage,” Reyes told the Journal. “Leverage kills when it goes the wrong way.”