Moody’s Investor Services (“Moody’s”), one of the most prominent global municipal bond credit rating services, reaffirmed the Village of Westbury’s bond ratings at Aa2 (which along with the AA+ rating ascribed by Standard & Poor’s Ratings Service are the highest bond ratings in the village’s history). The Moody’s report said that “Westbury has a very high quality credit position” including “a robust financial position” and carries “an exceptionally low debt liability.” The report cited the village for its “very healthy financial position” which is “favorable relative to the assigned rating” and cited a fund balance that was “materially higher than other Moody-rated cities nationwide.” The report also stated that Westbury’s ability to generate surplus operating margins was an attribute to their strong financial management.

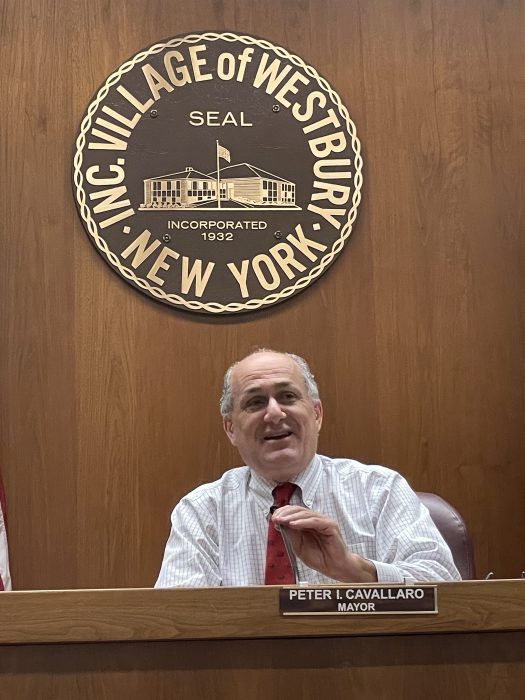

“Moody’s has confirmed that our strong management practices have resulted in an exceptionally strong financial position,” said Mayor Peter Cavallaro. “That affirmation is very gratifying to me and the board of trustees. More importantly, it should give our taxpayers comfort that this highly respected third party recognizes the village for prudent financial management and stewardship of their tax dollars.”

The mayor noted that the village has been able to build a strong financial position, while staying under the state-mandated cap for four years as well as addressing capital and infrastructure projects, including the repaving of 22 miles of roads.

“We are hopeful that this reaffirmation of the village’s financial condition and stewardship gives our residents and business owners, as well as those looking to do business or live here, the comfort of knowing that the village continues to be among the most fiscally strong and well managed municipalities on Long Island, and that Westbury is an economically attractive place to live, work and do business,” Cavallaro said.