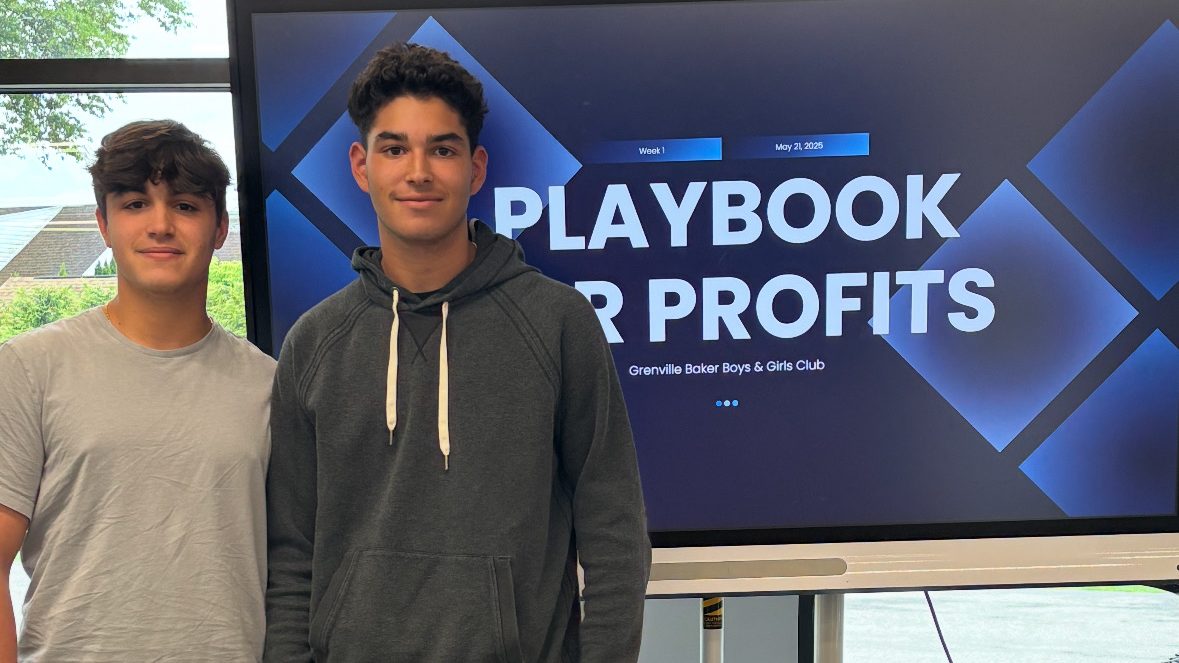

For most high school juniors, spring afternoons are filled with sports practices, homework, and exams. But for Roslyn High School students Ethan and Harrison Goldman, May was spent in a far different setting: standing at the front of a classroom, teaching a group of fifth graders how to understand branding, budgeting and the basics of financial literacy.

The two juniors developed and taught a four-week course at the Grenville Baker Boys and Girls Club in Locust Valley, creating their own curriculum after identifying a gap in early education around personal finance.

The result was an energetic, hands-on program that had 25 to 30 elementary school students designing shoe brands, debating prices, and using Monopoly money to build mock budgets.

“We wanted to teach the children about the business world and financial literacy, because that’s not what they’re being taught in schools right now,” Ethan said. “It’s an important skill for them to have for the future.”

The idea began forming last March, inspired by the business classes the boys have taken at Roslyn High School.

While the courses sparked their own interest in finance, the pair realized the curriculum didn’t start from true basics — basics they wish they had learned much earlier.

“After taking business classes in ninth and tenth grade, we realized everything started at a slightly higher level,” Harrison said. “We never had the chance to learn about these skills at a young age. That made us want to bring the fundamentals to younger kids.”

Fifth graders became the ideal audience for both practical and developmental reasons. The Boys and Girls Club typically offers programming for elementary-aged students, and the pair felt the age group struck the right balance between maturity and enthusiasm.

“They’re just about to go into middle school, so they’re more mature, but still really excited to try new things,” Harrison said. “We thought it was the perfect age to grasp the concepts while still having fun.”

To keep students engaged, the class combined short 10–15 minute mini-lessons with longer hands-on activities.

On the first day, students were given a blank sneaker outline and tasked with designing a unique shoe brand and logo.

The following week, they developed advertising campaigns—slogans, promotions, and display posters.

By the final session, the classroom had transformed into a bustling mock marketplace where students set prices, pitched their products, and used Monopoly money to “buy” their classmates’ creations.

“One of the most memorable moments was when the kids all started running around with their promotions, laughing and trying to sell their shoes,” Ethan said. “It really showed how engaged they were. They were creating their own ideas and wanting to put them into action.”

The brothers said one of the biggest challenges was simplifying financial concepts without watering them down.

“We had to find a balance between keeping them engaged and making sure the information wasn’t over their heads,” Harrison said. “If a concept feels too advanced, kids can shut down. So we had to break everything into steps they could actually understand and enjoy.”

By the third week, the boys noticed a major shift: students were no longer quiet or hesitant during discussion questions. Instead, hands shot up across the room.

“Kids were jumping out of their seats to answer,” Harrison said. “It showed us they were connecting with the material and wanting to share their own ideas.”

The success of the spring program has fueled plans for expansion.

The Goldmans already have dates scheduled to teach at East Hills Elementary School this January and have begun developing additional courses on topics such as credit scores, saving for major expenses, and introductory statistics. They recently launched a website, playbookforprofits.com, to share updates and resources as they grow the program.

“Our collaboration proved that this could work,” Ethan said. “We want to keep expanding and providing these opportunities in the community.”

Looking ahead to college, both students hope to pursue business-related majors—finance, economics, and statistics—continuing down the same path they are now helping introduce to younger students.

“Seeing the smiles on the kids’ faces and watching them take ownership of their ideas was the most rewarding part,” Ethan said. “It makes us want to keep doing this.”

For the fifth graders, the lessons were more than an activity, they were an early introduction to a world of concepts many students don’t encounter until high school or later.

For Ethan and Harrison, it’s just the beginning.