Long Island Republicans are opposing increasing MTA taxes on big businesses.

Under a state budget proposal announced by Gov. Kathy Hochul, Long Island companies with payrolls of $10 million may experience a 0.29% increase to the taxes they pay to the MTA. Companies with payrolls under that number will experience a decrease in their tax obligations, with the smallest companies, like those with payrolls under $1.75 million, possibly experiencing a 50% decrease. All numbers are only proposals until the budget passes.

The proposal is expected to generate $65 billion between 2025-2029, almost funding the MTA’s entire $68 billion capital plan, which includes station and service enhancements, repairs and LIRR improvements.

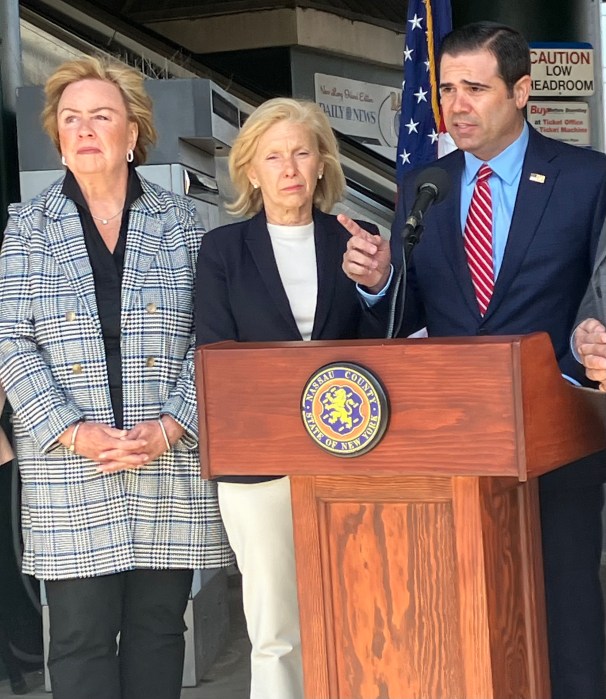

Nassau County Legislator John Ferretti spoke against the tax increase outside the Wantagh LIRR station Thursday morning, adding that he thought the MTA needed to be audited, streamlined and reformed instead of being provided with more funds.

“We are tired here in Nassau County of being the piggy banks for New York City and the governor’s attitude and getting absolutely nothing in the subway system,” Ferretti said, urging Long Islanders to call the governor’s office and express discontent with the plan. “There’s going to be employers that can’t give the raises they plan to. There are going to be employers who can’t hire in the numbers that they hope to hire for because of this increased tax levied by the governor.”

Gordon Tepper, a spokesman for Hochul’s office, defended the proposal, emphasizing the importance of ensuring the MTA is properly funded.

“The Long Island Rail Road is very important, and we have to support that through funding. This change to payroll taxes is one way to do it,” he said. “This is all for the MTA’s capital plan, which is infrastructure improvements to transportation. So you get more trains, faster trains. All the good things that we want related to public transportation have come at some cost,” Tepper added.

Roughly 301,000 people use the LIRR daily, many of whom are Nassau residents.

He also characterized Ferretti’s alarm over the tax change as unhelpful to his constituents, saying that alongside the proposed change to business taxes, the MTA would no longer levy a tax on local municipalities that the MTA passes through, including those in Nassau. He explained that this meant towns like Hempstead and North Hempstead would no longer be asked to pay taxes to the MTA. In turn, this would mean they would not have to pass that tax on to their residents, theoretically resulting in decreased tax payments.

“Mr. Ferretti wants to burden towns and small businesses with the cost of maintaining the LIRR so large corporations can pay less,” Tepper said. “Under Gov. Hochul’s plan, the Town of Hempstead is exempt, and small businesses actually see tax relief. Ferretti’s focus isn’t on solutions; it’s on political theater.”

The state’s budget is expected to pass in the coming days.