The Amsterdam at Harborside has emerged from bankruptcy protection after four months.

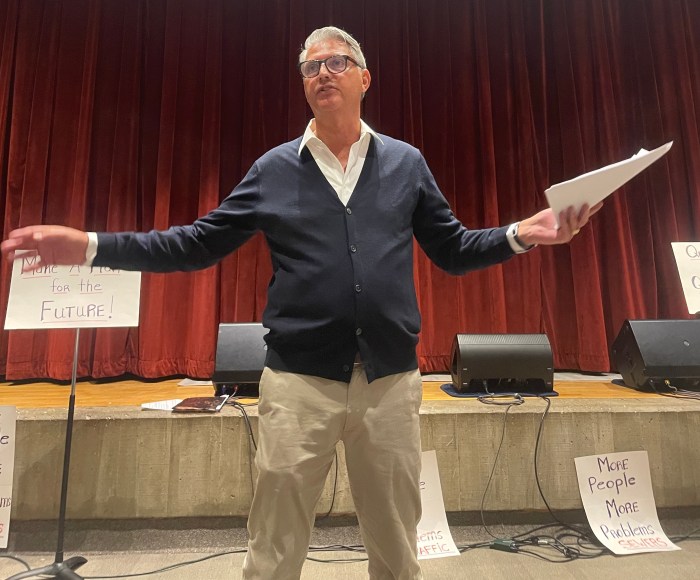

“We are optimistic about the future,” said James Davis, president and CEO. “Sales have picked up in the last 30 days. The number of closings in the last three months is up year over year and there is a significant increase in appointments with prospective buyers to see the Amsterdam and its lifestyle. These are all good signs.”

The Amsterdam, Nassau county’s only continuing care facility providing: housing, health care and long term care for a “buy in” price and monthly maintenance, encountered a “perfect storm” when it opened in 2010.

The facility was planned and developed over a number of years. However, the real estate market on Long Island in 2010 was reeling from the 2008 financial crisis. Homeowners intending to sell their homes and use the capital to fund their entry into the Amsterdam were unable to draw enough cash to finance the buy in, which ranges from $550,000 to $1.6 million, with the latter being a 2,600-square-foot penthouse unit. Monthly maintenance fees range from $3,100 to $7,000.

Last year, management acknowledged it could no longer service the facility’s debt and sought relief from bondholders.

In July, Davis announced a major step towards restructuring the debt. Management had negotiated and the board of directors approved an agreement with institutional investors that allowed for lower monthly

payments in return for extending

the life of the bonds. These large institutional investors own 75 percent of the debt.

However, a major hurdle remained. The remaining 25 percent of the bonds are held by 1,000 individual investors. According to terms of the original bonds, 100 percent of bondholders must agree to restructure the debt.

Davis said at that time: “The only way to relieve management from having to obtain the unanimous consent of 1,000 small investors is to enter into Chapter 11 proceedings (bankruptcy protection) which allows a judge to approve the negotiated plan agreed to by institutional investors.”

With the bankruptcy proceeding concluded, “We are moving forward in a more positive real estate environment,” said Davis. “Occupancy rate has increased from 84 percent in July, when Newsday headlined the possibility of a bankruptcy bringing sales literally to a halt, to 86 percent in January,” continued Davis.

Management said that payment on the debt and interest had been suspended during and immediately preceding the bankruptcy filing. However, all vendors had been paid, service to residents was maintained at the highest levels, new projects were implemented and employees were evaluated and granted pay increments, Davis said.

Debt service resumed in November. As part of the negotiated agreement with bondholders, management

must meet quarterly sales goals.

The first and second quarterly goals have been met. Of the 229 units, 197 are sold.

Although the future looks brighter, it should be noted that given the age of the population at the Amsterdam there is constant turnover which means that as new sales are made, previously occupied units may become available which can present a challenge in meeting sales targets that will continue to satisfy bondholders.

Executive Director Sam Guedouar isn’t worried. “Our residents have become our best advocates. They spread the word about our high level of service and the stimulating lifestyle we provide,” he said.