County Executive rules out layoffs and tax hike

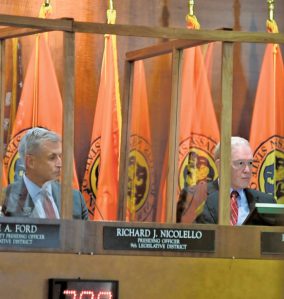

(Photo by Frank Rizzo)

In a worst case scenario, there will be up to 2,900 layoffs in the Nassau County workforce and a 60 percent increase in property taxes.

Those figures were cited in an Aug. 18 press release by the Nassau Interim Finance Authority (NIFA), the 20-year-old agency tasked with borrowing for the county and overseeing its finances.

It warned the scary outcome would be the end result if the Nassau County Legislature failed to approve County Executive Laura Curran’s debt restructuring plan.

The administration is seeking to close a budget gap it estimates at $385 million, and wants NIFA to delay a scheduled debt payment of $75 million on Nov. 15 to 2021. It would then use the cash from the debt service fund to narrow the gap. The legislature’s Republican majority is skeptical of the proposed move.

Curran also pushed back against the alarming figures presented by NIFA. According to spokesperson Michael Fricchione, she has ruled out both layoffs and a tax increase.

In his review of the county’s mid-year fiscal health, Nassau County Comptroller Jack Schnirman said, “The unprecedented storm of COVID-19 has been a gut punch to county finances and is upending progress.”

On Aug. 10, the administration presented its gap-closing plan to the legislature’s Budget Review Committee. This was in response to a rare subpoena by the majority to Deputy County Executive for Finance Raymond Orlando and Public Financial Management, Inc (PFM), the county’s financial consultants.

In a statement, Presiding Officer Richard Nicolello (R–New Hyde Park) expressed his skepticism with the restructuring plan, stating, “We are not prejudging any potential plan to address the county’s fiscal difficulties resulting from the COVID-19 pandemic. However, as the county’s elected representatives, we must review all possible options. The administration has…instead sought to ram through a refinancing plan that will burden residents with hundreds of millions in debt service and bureaucratic costs through 2051.”

Flexible Figures

Budget Director Andrew Persich, of the Office of Management and Budget, presented the case for the plan.

Persich said the county had been on an upward economic track before the pandemic hit. In contrast to past years, it ended fiscal year 2019 with a rainy day fund of $112 million and sales tax were increasing while personnel costs were being reduced.

“Our revenues, particularly sales taxes, dropped like a rock,” Persich observed after the corona-virus lockdown. “This budget is highly dependent on sales taxes, which account for 40 percent of our revenues.”

Though the latest sales tax collection figures were encouraging compared to the depths of the lockdown—down 12.9 percent year-to-year after drops of more than 30 percent in previous months—Persich said his office is being very conservative and expects a significant decline in sales tax relative to 2019.

This was in addition to expected declines in state aid as well as department revenues—things like red light cameras fines.

He warned that the traditionally strong fourth quarter, encompassing holiday shopping, might be undermined by a second wave of coronavirus and subsequent lockdown.

Committee Chair Howard Kopel (R–Lawrence) characterized Persich’s figures “as gloomy,” arguing that “economic activity is trending up.”

Persich pushed back, asserting that he had not seen a pattern yet, and had doubts about a strong economic recovery.

“This is something we’ve never experienced before,” Persich said of the pandemic, adding that the best estimate by his office was a 20 percent year-to-year decline in sales tax revenues. He admitted that figure could easily be 15 or 25 percent.

Kopel continued to argue for more optimistic sales tax figures presented by the county comptroller and the Office of Legislative Budget Review (OLBR).

The chair also expressed hope that federal aid will be forthcoming.

Persich was not sure that the political parties would agree on a relief package anytime soon, and “hope is not a strategy.”

Kopel presented alternate deficit figures, leading Persich to say, “We’re talking about a deficit of $385 million or $315 million or 300 whatever. It’s still 300, something I’ve never seen before. I’ve been doing this for 15 years. This is something I didn’t believe in, but I’m a believer now.”

Nicolello argued that the gap could be closed without deferring the debt payment. But Orlando disagreed, stating, “If we don’t restructure that $75 million, we will need to make [that amount of] cuts [elsewhere] this year.”

Orlando also objected to Nicolello’s criticism after he and Persich admitted they had not yet studied the county comptroller’s 2020 Mid-Year Report or the similar report issued by the OLBR.

“We’re trying to collect as much information from as many possible parties as we can,” Orlando said. “We don’t believe we have a monopoly on good ideas. We’re looking for ideas from everyone at all times. I can assure you that Andy and the team are tirelessly trying to find a way to keep the county’s finances together at the most effective level with the least amount of damage to the services that the county businesses, residents and taxpayers demand and deserve.”

Minority Leader Kevan M. Abrahams, citing a possible second wave, hoped that the administration had “other contingencies in place to mitigate shortfalls if sales taxes drop more than 20 percent or other issues develop.”

Orlando admitted that there was a lot of uncertainty ahead, “and we’re in a very treacherous environment,” but was confident of his team’s ability to assess the risks.

Later this month, Curran will unveil her 2021 proposed budget. After the Aug. 10 hearing, she sent a letter to Nicolello and Abrahams “calling for more robust and informed discussions with NIFA to strategize for the county’s 2021 budget and gap closing plan to ensure full transparency and to get all hands on deck to develop future strategies.”

Nicolello, in a statement, said, “As a result of the hearing and the subpoenas we served, the legislature is finally getting information about the administration’s plans to address the financial crisis caused by the COVID-related shutdown. We will work with all stakeholders to find solutions, but will oppose any effort to raise taxes. With so many residents still out of work and so many businesses shut or struggling, government cannot add to the burdens already facing our residents.”