The Village of Farmingdale adopted a $4,776,337 net budget for the 2026 fiscal year and exceeded the tax cap for the first time in the village’s history.

The Board of Trustees entered the Monday, April 14, meeting expecting to pass a budget that would carry a 7.55% tax levy increase, well over the 1.79% tax cap. After two hours of discussions, the district lowered its tax cap to 3.27%, which still pierces the cap.

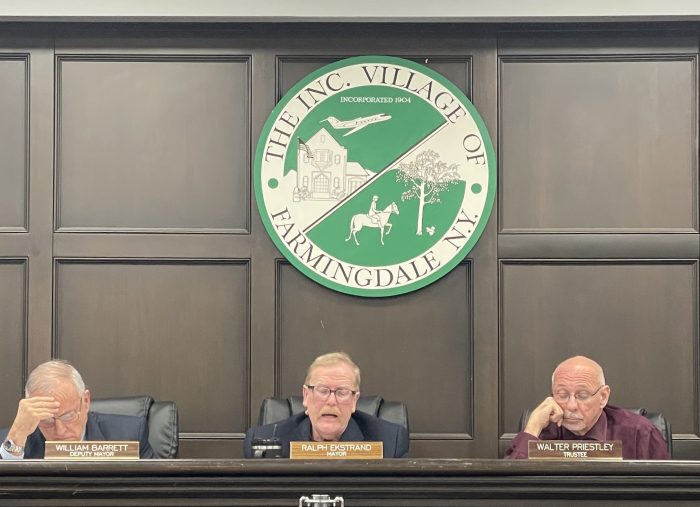

The first public hearing of the night was to exceed the tax cap, which was narrowly approved. Trustee Cheryl Parish and Deputy Mayor William Barrett voted against the move. Parish said she was concerned with the state of the economy and said residents “could use a break.”

“You could have 1,000 residents come here and I’m still going to say we need to pierce the tax cap,” Mayor Ralph Ekstrand said. “I don’t care about perception. I care about doing what is right.”

The decrease in the tax cap was largely due in part to the village raising its parking meter price to 75 cents per hour. This decision added an estimated $132,000 in revenue to the budget. The village also confirmed it cut expenditures by $51,500 through a resolution before adopting the budget.

Trustee Craig Rosasco asked the board if raising the price to $1 per hour would keep the village under the tax cap, to which the other board members agreed that it would be best to gradually raise the price instead of doing it all at once.

“We’re going to see a lot of people piercing the cap and we just minimized the damage,” Roscasco said.

Brian Harty, the village clerk, called it a great compromise.

The board also tabled a conversation to raise their own salaries to a later date.

The village also approved the tax shares as 65.8928% with a tax levy of $2,919,932 for homesteads and 34.1072% with a tax levy of $1,511,405 for non-homesteads. The village said corresponding tax rates are $2.295677/1,000 in assessed value for homestead and $4.401775/1,000 in assessed value for non-homestead.

The village operated with a $7,814,046.35 budget for the 2025 fiscal year. That budget is set to expire on May 31.