These days Long Island residents are trying to save a buck whenever and wherever they can, especially when it comes to property taxes. To try and lend a helping hand Republican Sen. Kemp Hannon and Nassau County Executive Ed Mangano recently teamed up for a property tax exemption workshop at the Levittown Public Library.

Communications Director Randolph Yunker with the Nassau County Department of Assessment explained that the workshop was a collaborative effort to bring the Assessments office operations from Mineola to different communities in the county.

“If it wasn’t for Sen. Hannon we wouldn’t have half of the laws that we currently do regarding tax exemptions for the public,” Yunker said. “Levittown is one of those [communities] that we frequent… We get a lot of applicants here, mostly because there are less commercial properties in certain areas that the homeowner portion of the property tax obligation is higher, so they’re looking for ways to reduce it.”

Hannon said that bringing the tax exemption workshop to the people in settings such as the Levittown Library was merely a logical — and more convenient — extension of the services available every day that some residents might not be aware of.

“We realized that all too often we have skipped over existing property tax exemptions that can benefit people a great deal,” Hannon said. “So, we have the County Assessor’s Office here with all of their experts, and we’re looking at things such as Senior Citizen tax exemptions, Veteran’s tax exemptions… Anything that can help with the most dreaded tax of all, property tax.”

Hannon acknowledged that the number one woe for most Long Island residents are their overbearing property taxes, which is especially true for members of our most venerable population, he said.

“It’s heartbreaking… as you can see, the average age here is a bit over 70,” he said. “These are people who are on fixed incomes and they don’t realize that they’re entitled to tax breaks, and those extra dollars are essential to keeping their lives going.”

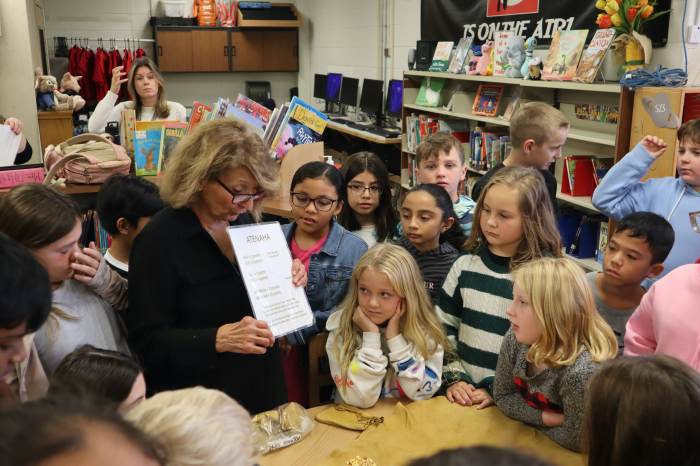

During the workshop, staff members with the County Assessor’s office were on-hand in case any attendees were first-timers or pursuing a renewal of an existing property tax exemption.

“As people become older and they have a different economic outlook, they may be eligible for something that just a few years before they may not have been. If people need help, we’re there on a daily basis,” Hannon said.

Long-time Levittown resident Bernard Ocasio has an especially large chip on his shoulder when it comes to his taxes, and today he was at the workshop to try and do something about them.

“I’ve been living here since 1974 and all I see are my taxes going up every year,” Ocasio said.“They never remain the same, especially the school taxes. I’m 75 years old, and I can’t afford to pay any more than I do now, so I’m hoping that the applications I will be submitting here today will help me finally catch a break for once.”

Seaford resident Mary Laub said that after she lost her husband, several years back, she inherited his job of maintaining the family finances. In order to get a helping hand — and possibly save a few dollars in the process — Laub attended the workshop in Levittown.

“I had some trouble filling out the paperwork… I didn’t know what to bring,” she said. “So far, they’ve been very helpful.”

Joe Stanley of Levittown already had all his paperwork filled out, and merely attended the workshop to put them on file. However, he was willing to share his feelings on what he called the

“unreasonable issues” that many Long Island seniors face when it comes to their property taxes.

“I want to make sure that I filled out everything correctly and get the ball rolling on possibly getting an exemption… especially the low-income one,” he said. “Taxes on Long Island are totally unfair. For example, why should seniors pay school tax? School tax should be paid as the child enters school… If you have five kids, you pay five times. And what about people living in apartments? They don’t pay that tax at all.”

Applications and specific documentation requirements are available on the Department of Assessment website at www.mynassauproperty.com.